Question: Exercise 4-4 Work sheet interpretation and closing entries Q 101, Q3 Below are excerpts from the work sheets of two businesses as at March 31,

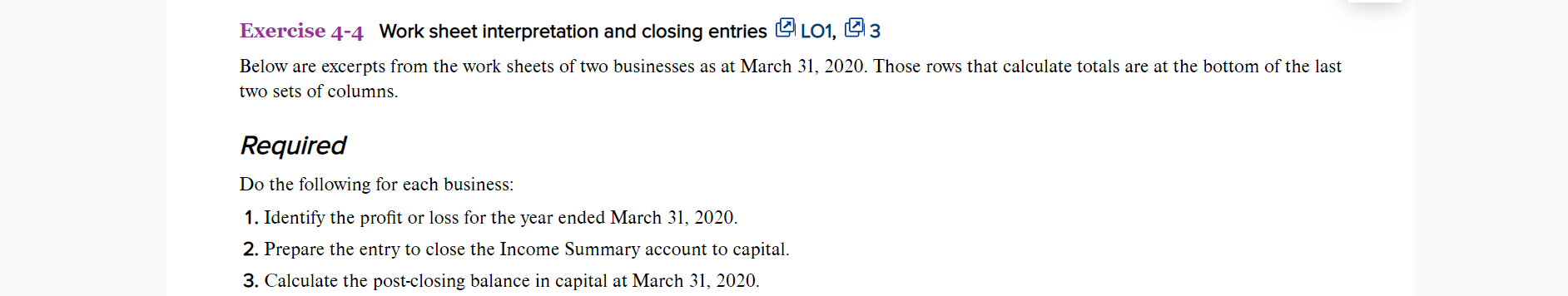

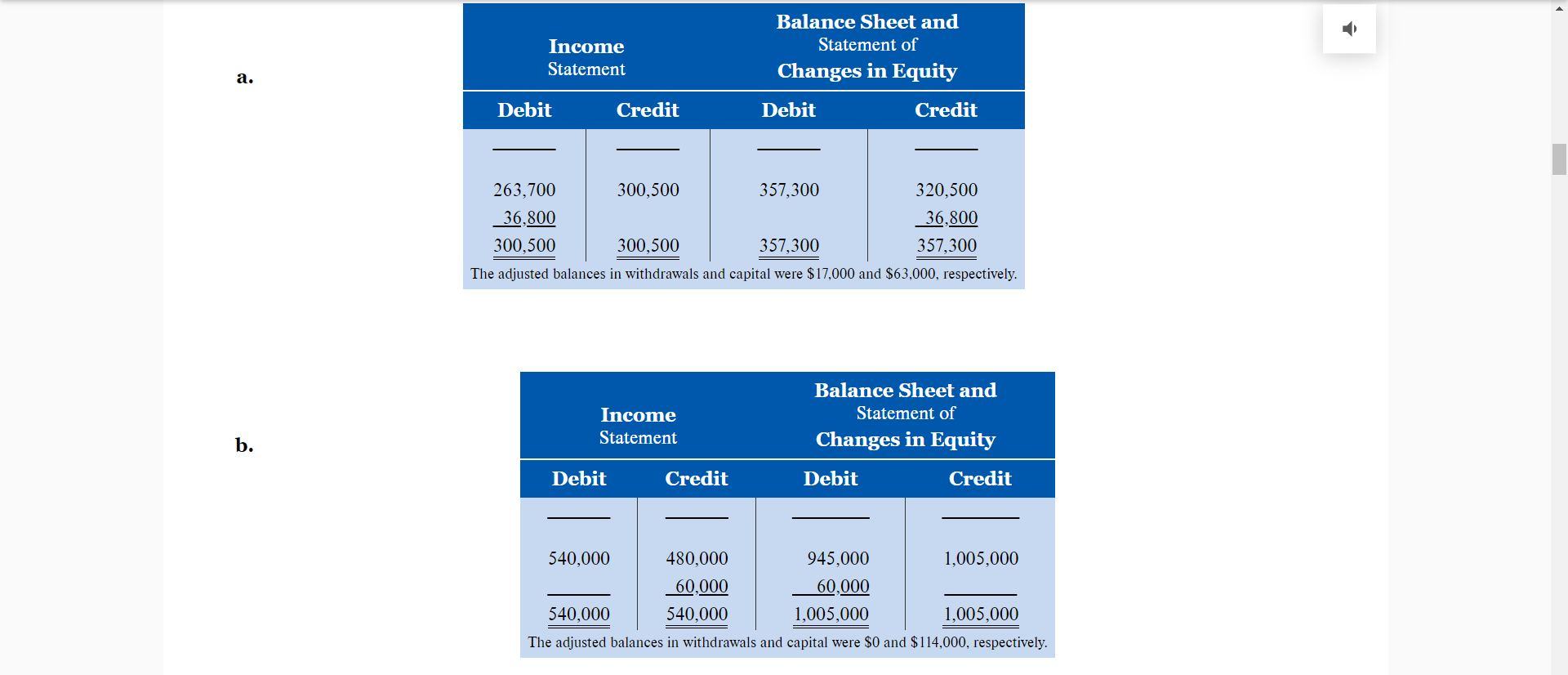

Exercise 4-4 Work sheet interpretation and closing entries Q 101, Q3 Below are excerpts from the work sheets of two businesses as at March 31, 2020. Those rows that calculate totals are at the bottom of the last two sets of columns. Required Do the following for each business: 1. Identify the profit or loss for the year ended March 31, 2020. 2. Prepare the entry to close the Income Summary account to capital. 3. Calculate the post-closing balance in capital at March 31, 2020. Income Statement Balance Sheet and Statement of Changes in Equity a. Debit Credit Debit Credit 263,700 300,500 357,300 320,500 36,800 36,800 300,500 300,500 357,300 357,300 The adjusted balances in withdrawals and capital were $17,000 and $63,000, respectively. Income Statement Balance Sheet and Statement of Changes in Equity b. Debit Credit Debit Credit 540,000 480,000 945,000 1,005,000 60,000 60,000 540,000 540,000 1,005,000 1,005,000 The adjusted balances in withdrawals and capital were $0 and $ 114,000, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts