Question: Exercise 4-5 Your answer is partially correct. Try again In its first year of operations, Blossom Company recognized $31,700 in service revenue, $6,700 of which

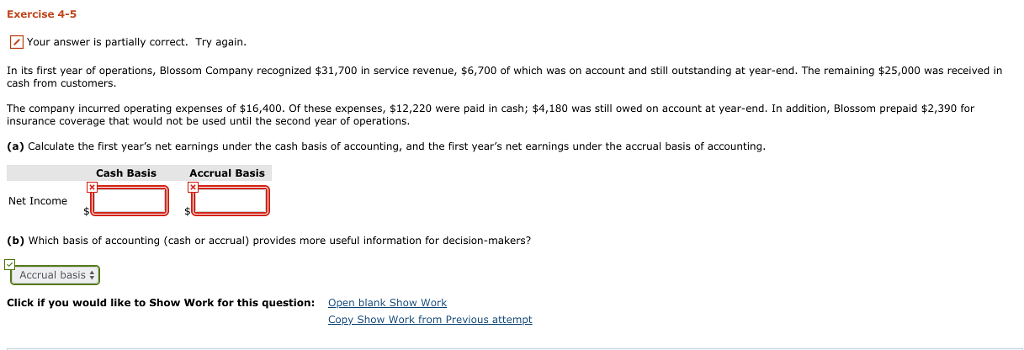

Exercise 4-5 Your answer is partially correct. Try again In its first year of operations, Blossom Company recognized $31,700 in service revenue, $6,700 of which was on account and still outstanding at year-end. The remaining $25,000 was received in cash from customers. The company incurred operating expenses of $16,400. Of these expenses, $12,220 were paid in cash; $4,180 was still owed on account at year-end. In addition, Blossom prepaid $2,390 for insurance coverage that would not be used until the second year of operations. (a) Calculate the first year's net earnings under the cash basis of accounting, and the first year's net earnings under the accrual basis of accounting. Cash Basis Accrual Basis Net Income (b) Which basis of accounting (cash or accrual) provides more useful information for decision-makers? Accrual basis # Click if you would like to Show Work for this question: Open blank Show Work Copy Show Work from Previous attempt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts