Question: Exercise 4-7 Income statement presentation: discontinued operations; restructuring costs (L 04-1, 4-3, 4. 4] Esquire Comic Book Company had income before tax of $1.850,000 in

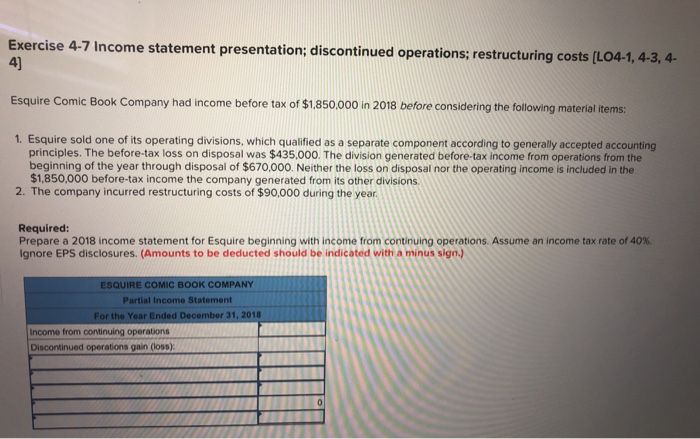

Exercise 4-7 Income statement presentation: discontinued operations; restructuring costs (L 04-1, 4-3, 4. 4] Esquire Comic Book Company had income before tax of $1.850,000 in 2018 before considering the following material tems: 1. Esquire sold one of its operating divisions, which qualified as a separate component according to generally accepted accounting principles. The before-tax loss on disposal was $435,000. The division generated before-tax income from operations from the beginning of the year through disposal of $670.000. Neither the loss on disposal nor the operating income is included in the $1,850,000 before-tax income the company generated from its other divisions 2. The company incurred restructuring costs of $90.000 during the year Required Prepare a 2018 income statement for Esquire beginning with income from continuing operations. Assume an income tax rate of 40%. Ignore EPS disclosures. (Amounts to be deducted should be indicated witth a minus sign.) ESQUIRE COMIC BOOK COMPANY Partial Income Statement For the Year Ended December 31, 2018 Income from continuing operations Discontinued operations gain (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts