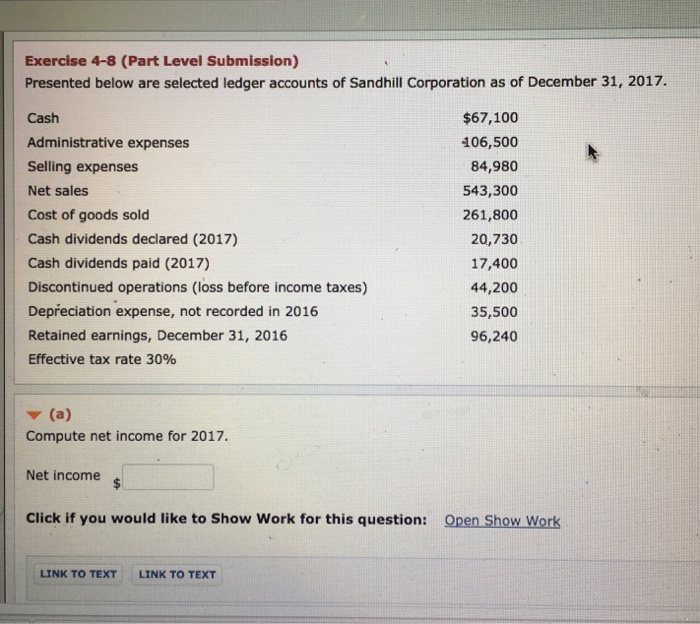

Question: Exercise 4-8 (Part Level Submission) Presented below are selected ledger accounts of Sandhill Corporation as of December 31, 2017. Cash Administrative expenses Selling expenses Net

Exercise 4-8 (Part Level Submission) Presented below are selected ledger accounts of Sandhill Corporation as of December 31, 2017. Cash Administrative expenses Selling expenses Net sales Cost of goods sold Cash dividends declared (2017) Cash dividends paid (2017) Discontinued operations (loss before income taxes) Depreciation expense, not recorded in 2016 Retained earnings, December 31, 2016 Effective tax rate 30% $67,100 106,500 84,980 543,300 261,800 20,730 17,400 44,200 35,500 96,240 (a) Compute net income for 2017. Net income Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts