Question: Exercise 4-9 (Algo) Preparing closing entries and a post-closing trial balance LO P2 Following are accounts and year-end adjusted balances of Cruz Company as of

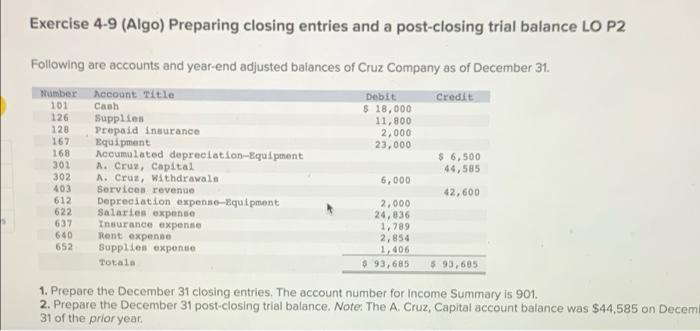

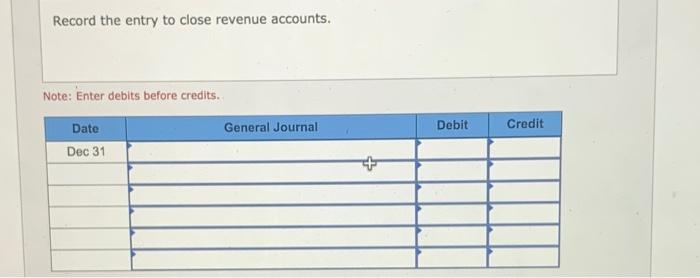

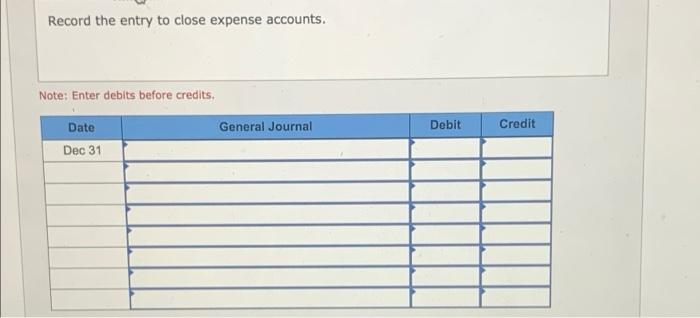

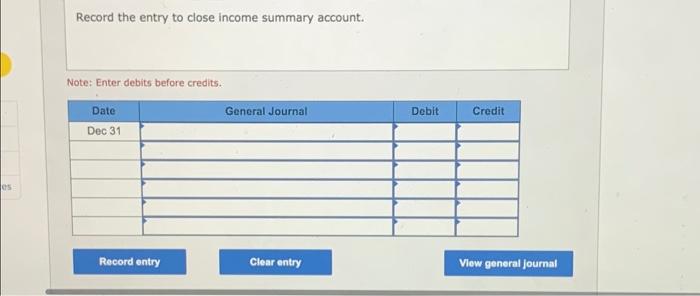

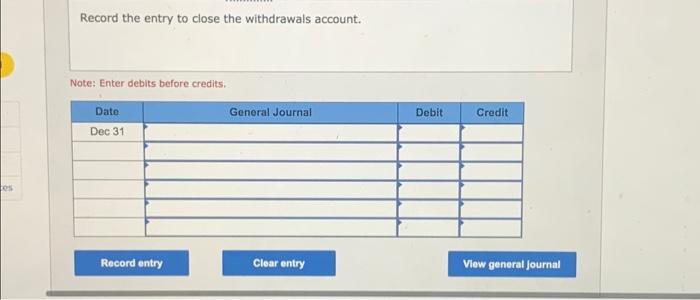

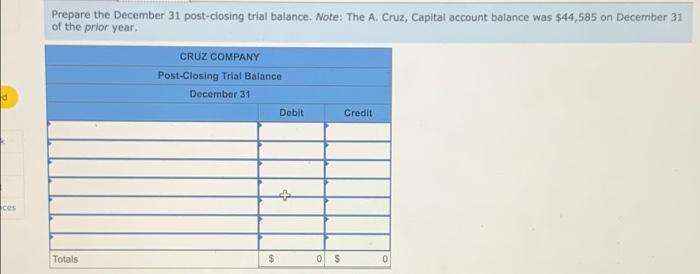

Exercise 4-9 (Algo) Preparing closing entries and a post-closing trial balance LO P2 Following are accounts and year-end adjusted balances of Cruz Company as of December 31. Number Account Title Debit Credit 101 Cash $ 18,000 126 Supplies 11,800 128 Prepaid insurance 2,000 167 Equipment 23,000 168 Accumulated depreciation Equipment $ 6,500 302 A. Cruz, Capital 44,585 302 A. Crus, Withdrawals 6,000 403 Services revenue 42,600 612 Depreciation expense-Equipment 2,000 622 Salaries expense 24,836 637 Insurance expense 1,789 640 Rent expense 2,854 652 Supplies expende 1,406 Totala $ 93,685 593,685 1. Prepare the December 31 closing entries. The account number for Income Summary is 901. 2. Prepare the December 31 post-closing trial balance. Note: The A. Cruz, Capital account balance was $44,585 on Decem 31 of the prior year Record the entry to close revenue accounts. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 + + Record the entry to close expense accounts. Note: Enter debits before credits. Date General Journal Dec 31 Debit Credit Record the entry to close income summary account. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 es Record entry Clear entry View general Journal Record the entry to close the withdrawals account. Note: Enter debits before credits. Date General Journal Dec 31 Debit Credit os Record entry Clear entry View general Journal Prepare the December 31 post-closing trial balance. Note: The A. Cruz, Capital account balance was $44,585 on December 31 of the prior year. CRUZ COMPANY Post-Closing Trial Balance d December 31 Dobit Credit ces Totals $ $ 0 S 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts