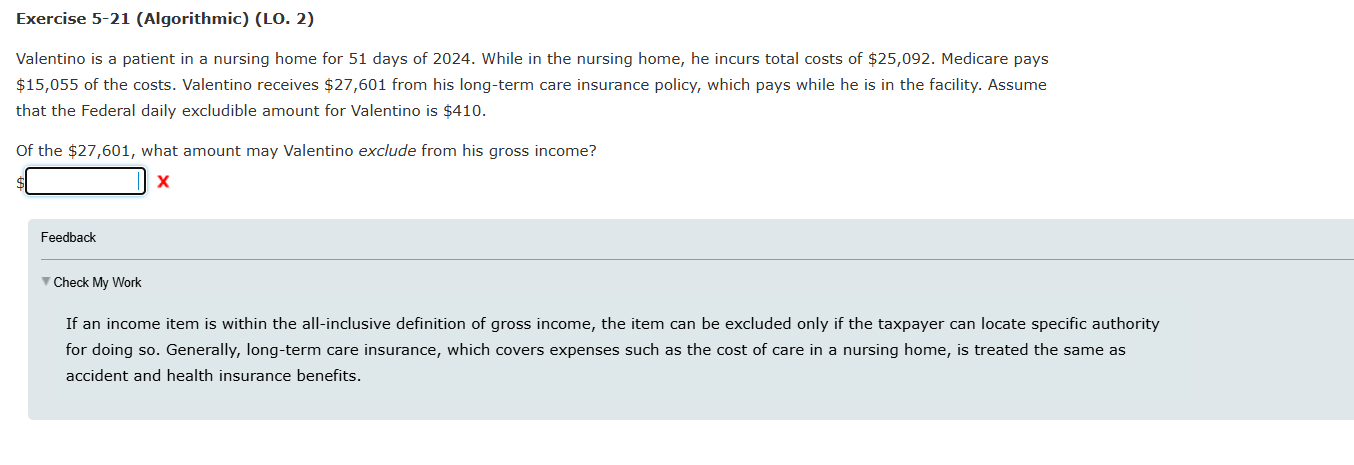

Question: Exercise 5 - 2 1 ( Algorithmic ) ( LO . 2 ) Valentino is a patient in a nursing home for 5 1 days

Exercise AlgorithmicLO Valentino is a patient in a nursing home for days of While in the nursing home, he incurs total costs of $ Medicare pays $ of the costs. Valentino receives $ from his longterm care insurance policy, which pays while he is in the facility. Assume that the Federal daily excludible amount for Valentino is $ Of the $ what amount may Valentino exclude from his gross income? $ X Feedback v Check My Work If an income item is within the allinclusive definition of gross income, the item can be excluded only if the taxpayer can locate specific authority for doing so Generally, longterm care insurance, which covers expenses such as the cost of care in a nursing home, is treated the same as accident and health insurance benefits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock