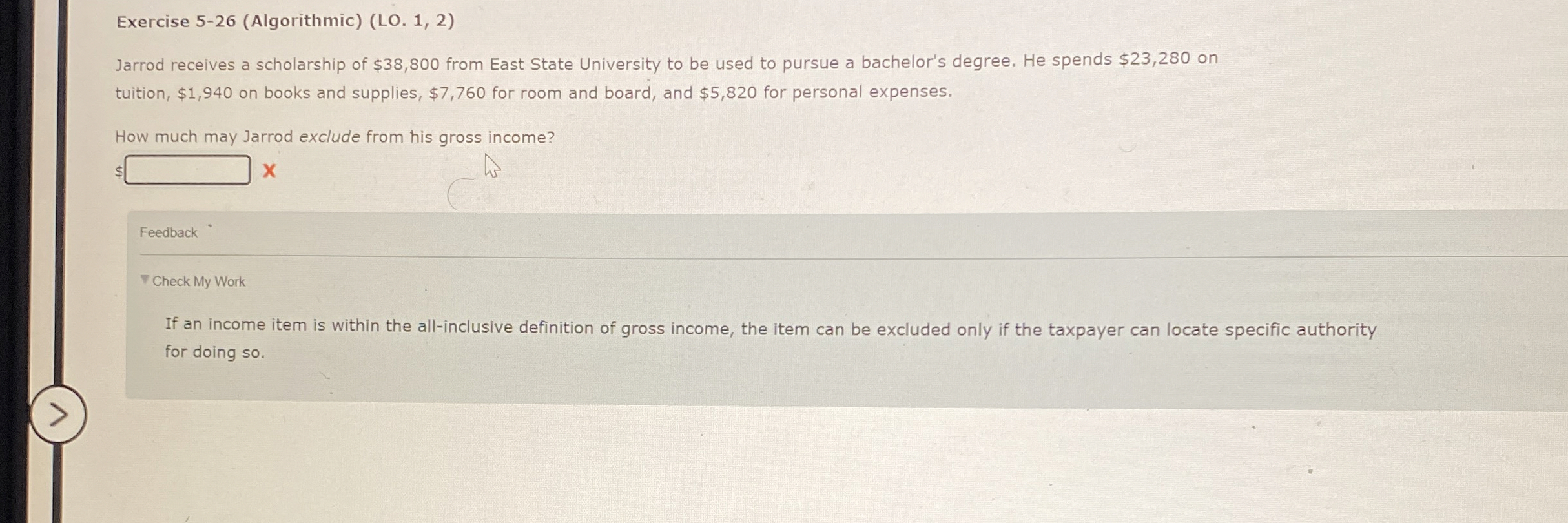

Question: Exercise 5 - 2 6 ( Algorithmic ) ( LO . 1 , 2 ) Jarrod receives a scholarship of $ 3 8 , 8

Exercise AlgorithmicLO

Jarrod receives a scholarship of $ from East State University to be used to pursue a bachelor's degree. He spends $ on

tuition, $ on books and supplies, $ for room and board, and $ for personal expenses.

How much may Jarrod exclude from his gross income?

$

Feedback

TCheck My Work

If an income item is within the allinclusive definition of gross income, the item can be excluded only if the taxpayer can locate specific authority

for doing so

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock