Question: Exercise 5 (Spring 2019) You have been asked to estimate the cost of capital for Baklak Stores, a firm that generates all of its revenues

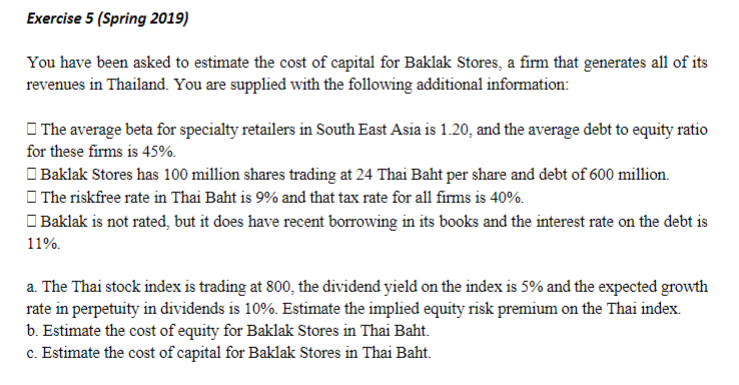

Exercise 5 (Spring 2019) You have been asked to estimate the cost of capital for Baklak Stores, a firm that generates all of its revenues in Thailand. You are supplied with the following additional information: The average beta for specialty retailers in South East Asia is 1.20, and the average debt to equity ratio for these firms is 45%. Baklak Stores has 100 million shares trading at 24 Thai Baht per share and debt of 600 million. The riskfree rate in Thai Baht is 9% and that tax rate for all firms is 40%. Baklak is not rated, but it does have recent borrowing in its books and the interest rate on the debt is 11% a. The Thai stock index is trading at 800, the dividend yield on the index is 5% and the expected growth rate in perpetuity in dividends is 10%. Estimate the implied equity risk premium on the Thai index. b. Estimate the cost of equity for Baklak Stores in Thai Baht. c. Estimate the cost of capital for Baklak Stores in Thai Baht

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts