Question: Exercise 5. Use Excel or something similar for this exercise. Collect five years of monthly price data for two stocks. Calculate the returns. Compute the

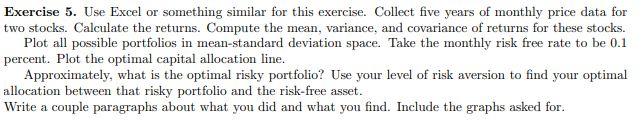

Exercise 5. Use Excel or something similar for this exercise. Collect five years of monthly price data for two stocks. Calculate the returns. Compute the mean, variance, and covariance of returns for these stocks. Plot all possible portfolios in mean-standard deviation space. Take the monthly risk free rate to be 0.1 percent. Plot the optimal capital allocation line. Approximately, what is the optimal risky portfolio? Use your level of risk aversion to find your optimal allocation between that risky portfolio and the risk-free asset. Write a couple paragraphs about what you did and what you find. Include the graphs asked for. Exercise 5. Use Excel or something similar for this exercise. Collect five years of monthly price data for two stocks. Calculate the returns. Compute the mean, variance, and covariance of returns for these stocks. Plot all possible portfolios in mean-standard deviation space. Take the monthly risk free rate to be 0.1 percent. Plot the optimal capital allocation line. Approximately, what is the optimal risky portfolio? Use your level of risk aversion to find your optimal allocation between that risky portfolio and the risk-free asset. Write a couple paragraphs about what you did and what you find. Include the graphs asked for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts