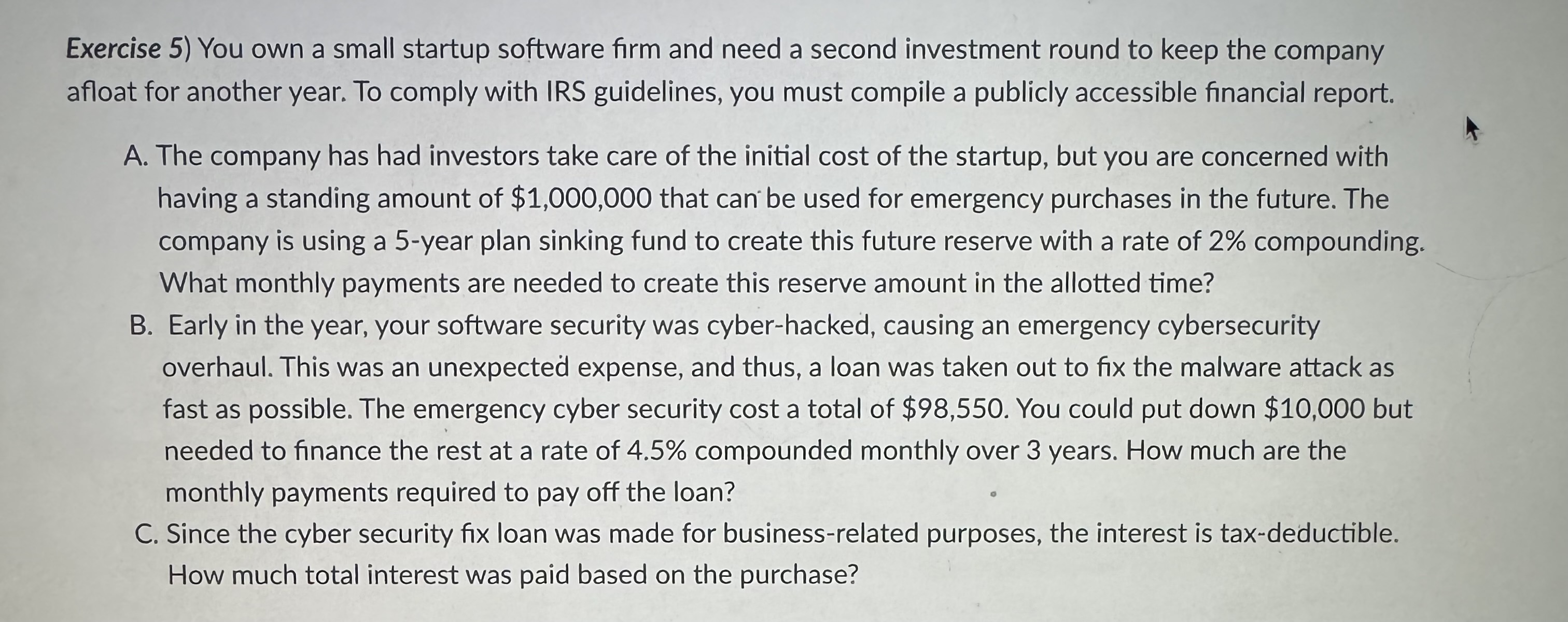

Question: Exercise 5 ) You own a small startup software firm and need a second investment round to keep the company afloat for another year. To

Exercise You own a small startup software firm and need a second investment round to keep the company

afloat for another year. To comply with IRS guidelines, you must compile a publicly accessible financial report.

A The company has had investors take care of the initial cost of the startup, but you are concerned with

having a standing amount of $ that can be used for emergency purchases in the future. The

company is using a year plan sinking fund to create this future reserve with a rate of compounding.

What monthly payments are needed to create this reserve amount in the allotted time?

B Early in the year, your software security was cyberhacked, causing an emergency cybersecurity

overhaul. This was an unexpected expense, and thus, a loan was taken out to fix the malware attack as

fast as possible. The emergency cyber security cost a total of $ You could put down $ but

needed to finance the rest at a rate of compounded monthly over years. How much are the

monthly payments required to pay off the loan?

C Since the cyber security fix loan was made for businessrelated purposes, the interest is taxdeductible.

How much total interest was paid based on the purchase?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock