Question: Exercise 5-07 (Part Level Submission) Presented below is information for Crane Co. for the month of January 2022. Cost of goods sold Freight-out Insurance expense

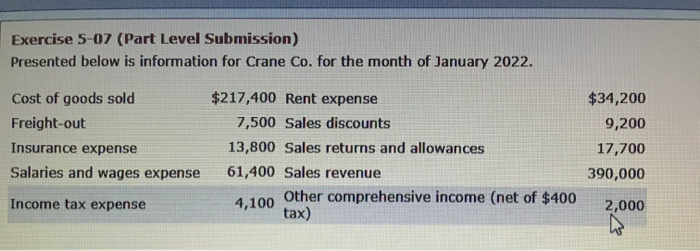

Exercise 5-07 (Part Level Submission) Presented below is information for Crane Co. for the month of January 2022. Cost of goods sold Freight-out Insurance expense Salaries and wages expense $217,400 Rent expense 7,500 Sales discounts 13,800 Sales returns and allowances 61,400 Sales revenue 4,100 Other comprehensive income (net of $400 tax) $34,200 9,200 17,700 390,000 Income tax expense 2,000 2.000 (c) Calculate the profit margin and the gross profit rate. (Round answers to 1 decimal place, e.g. 15.2%.) Profit margin % Gross profit rate %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts