Question: Exercise 5-1 Preparing a Contribution Format Income Statement [LO5-1] Whirly Corporation's most recent income statement is shown below: Sales (7,900 units) Variable expenses Total $

![Exercise 5-1 Preparing a Contribution Format Income Statement [LO5-1] Whirly Corporation's](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6c280aaeda_10466e6c2804aa90.jpg)

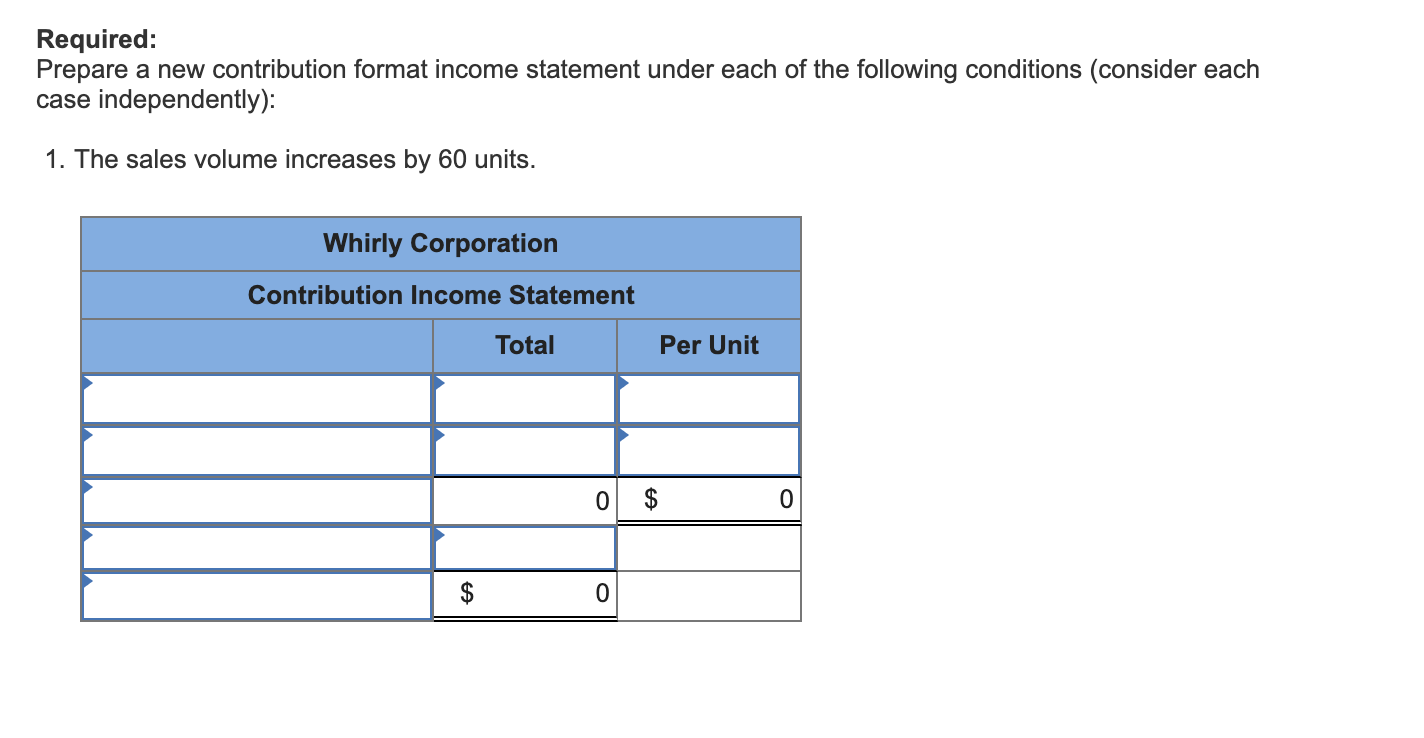

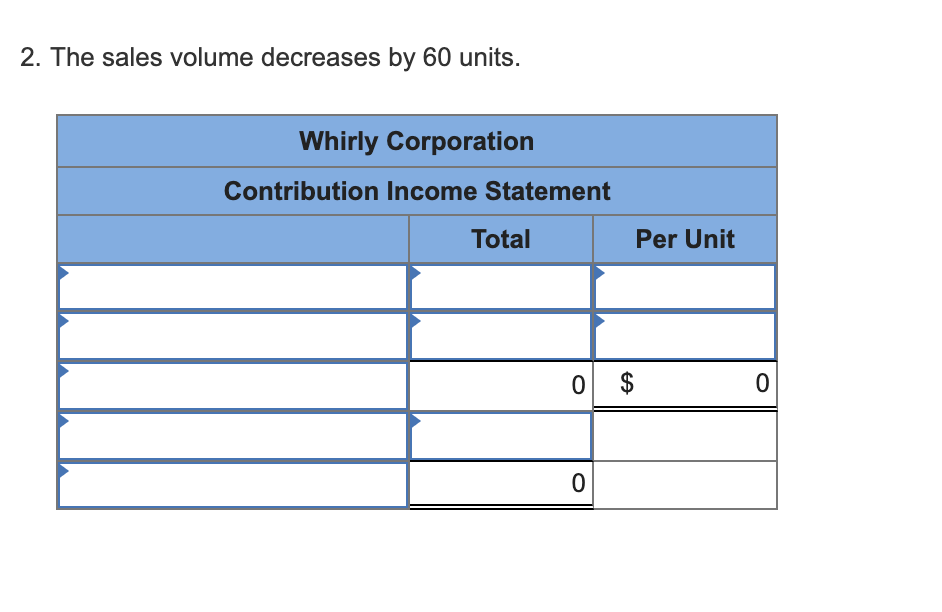

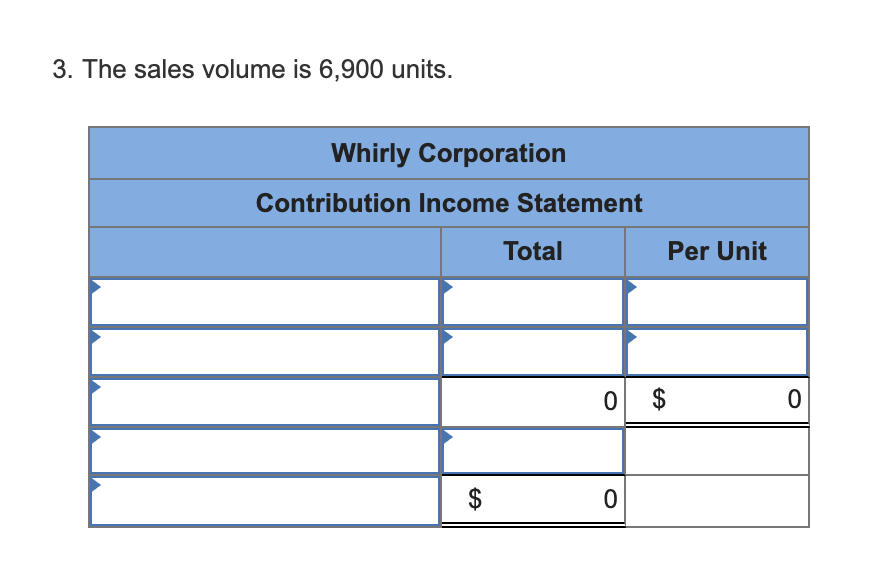

Exercise 5-1 Preparing a Contribution Format Income Statement [LO5-1] Whirly Corporation's most recent income statement is shown below: Sales (7,900 units) Variable expenses Total $ 260,700 150,100 Per Unit $33.00 19.00 $ 14.00 Contribution margin Fixed expenses 110,600 54,700 Net operating income $ 55,900 Required: Prepare a new contribution format income statement under each of the following conditions (consider each case independently): 1. The sales volume increases by 60 units. Whirly Corporation Contribution Income Statement Total Per Unit 0 $ 0 | $ 0 2. The sales volume decreases by 60 units. Whirly Corporation Contribution Income Statement Total Per Unit 0 $ 0 3. The sales volume is 6,900 units. Whirly Corporation Contribution Income Statement Total Per Unit 0 $ 0 | $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts