Question: Exercise 5-11 Comparing LIFO numbers to FIFO numbers; ratio analysis LO A1, A3 Cruz Company uses LIFO for inventory costing and reports the following financial

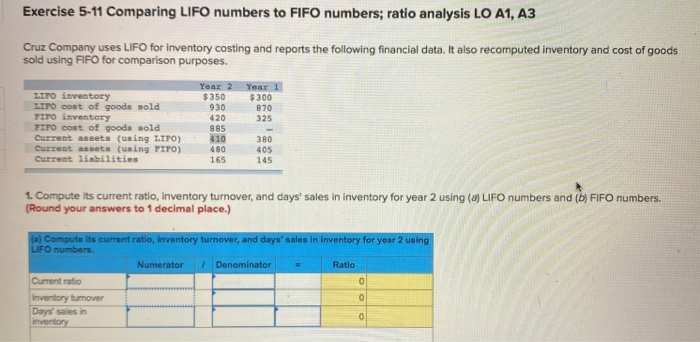

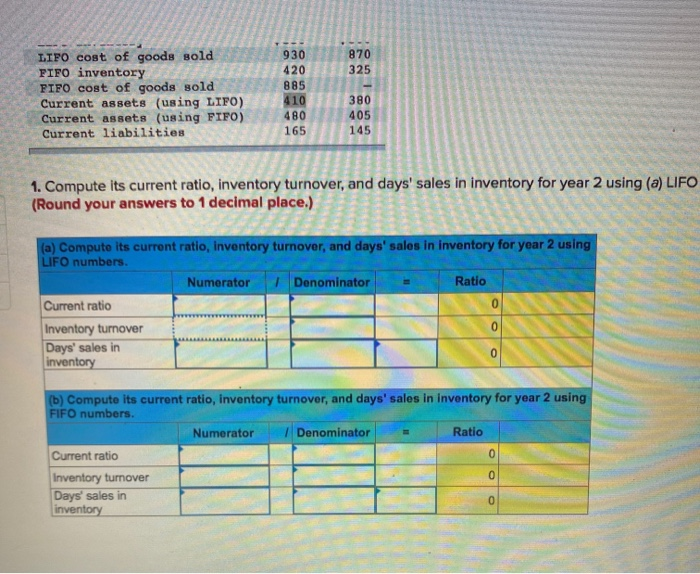

Exercise 5-11 Comparing LIFO numbers to FIFO numbers; ratio analysis LO A1, A3 Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods sold using FIFO for comparison purposes. Year 2 $350 930 420 Year 1 $300 870 325 LIPO inventory LIPO cost of goods sold TIPO inventory PIPO cost of goods sold Current assets (using LIPO) Current assets (using PIPO) Current liabilities 885 410 480 165 380 405 145 1. Compute its current ratio, inventory turnover, and days' sales in inventory for year 2 using (a) LIFO numbers and (b) FIFO numbers. (Round your answers to 1 decimal place.) (a) Compute its current ratio, inventory turnover, and days' sales in Inventory for year 2 using LIFO numbers Numerator 1 Denominator Ratio Current ratio Inventory turnover Days' sales in inventory OOO 870 325 LIFO cost of goods sold FIFO inventory FIFO cost of goods sold Current assets (using LIFO) Current assets (using FIFO) Current liabilities 930 420 885 410 480 165 380 405 145 1. Compute its current ratio, inventory turnover, and days' sales in inventory for year 2 using (a) LIFO (Round your answers to 1 decimal place.) (a) Compute its current ratio, inventory turnover, and days' sales in inventory for year 2 using LIFO numbers Numerator I Denominator Ratio Current ratio 0 Inventory turnover 0 Days' sales in inventory 0 (b) Compute its current ratio, inventory turnover, and days' sales in inventory for year 2 using FIFO numbers. Numerator / Denominator Ratio Current ratio 0 Inventory turnover 0 Days' sales in 0 inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts