Question: Exercise 5-11A (Algo) Allocating facility-level costs and a product elimination decision LO 5-3 Baird Boards produces two kinds of skateboards. Selected unit data for the

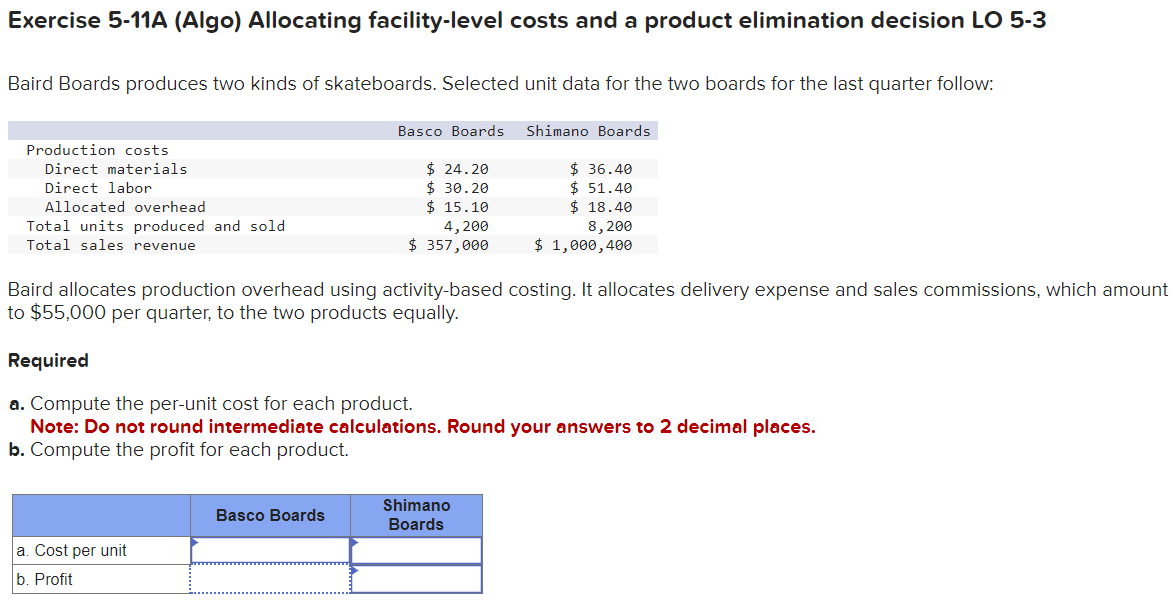

Exercise 5-11A (Algo) Allocating facility-level costs and a product elimination decision LO 5-3 Baird Boards produces two kinds of skateboards. Selected unit data for the two boards for the last quarter follow: Basco Boards Shimano Boards Production costs Direct materials % 24.20 % 36.40 Direct labor % 30.20 % 51.4@ Allocated overhead % 15.1@ % 18.48 Total units produced and sold 4,200 8,200 Total sales revenue % 357,000 % 1,000,400 Baird allocates production overhead using activity-based costing. It allocates delivery expense and sales commissions, which amount to $55,000 per quarter, to the two products equally. Required a. Compute the per-unit cost for each product. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. b. Compute the profit for each product. a. Cost per unit b. Profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts