Question: Exercise 5-18 (Algo) Solving for unknowns; annuities [LO5-9] For each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded

![Exercise 5-18 (Algo) Solving for unknowns; annuities [LO5-9] For each of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e963ad4ebe7_43666e963ace2e5c.jpg)

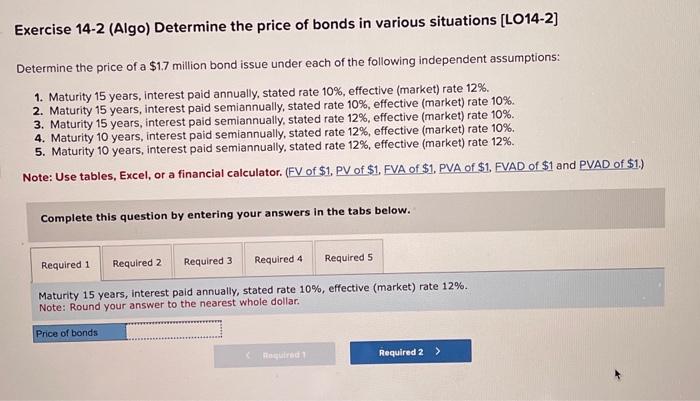

Exercise 5-18 (Algo) Solving for unknowns; annuities [LO5-9] For each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are recelved at the end of each period. ( (= interest rate, and n= number of years) Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of S1, PV of S1, FVA of \$1, PVA of \$1, EVAD of \$1 and PVAD of \$1) Exercise 14-2 (Algo) Determine the price of bonds in various situations [LO14-2] Determine the price of a $1.7 million bond issue under each of the following independent assumptions: 1. Maturity 15 years, interest paid annually, stated rate 10%, effective (market) rate 12%, 2. Maturity 15 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%. 3. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1.) Complete this question by entering your answers in the tabs below. Maturity 15 years, interest paid annually, stated rate 10%, effective (market) rate 12%. Note: Round your answer to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts