Question: Exercise 5-22 (Static) Complete the accounting cycle using receivable transactions (LO5-1, 5-2, 5-4, 55,57)(GL) The general ledger of Pop's Fireworks includes the following account balances

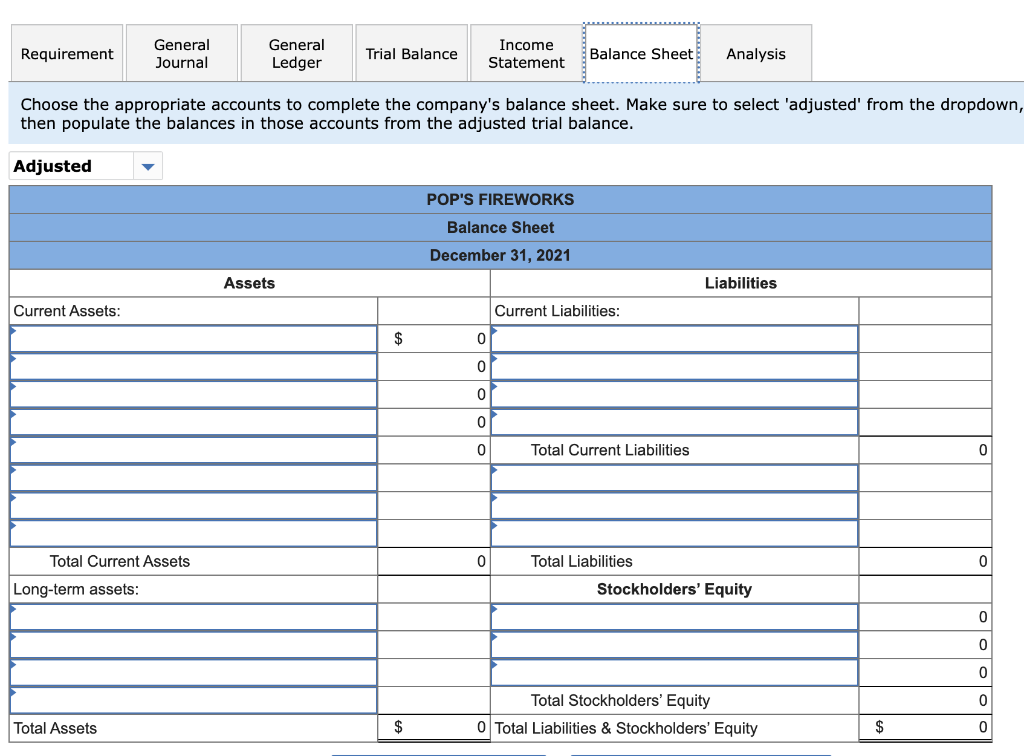

Exercise 5-22 (Static) Complete the accounting cycle using receivable transactions (LO5-1, 5-2, 5-4, 55,57)(GL) The general ledger of Pop's Fireworks includes the following account balances in 2024: In addition, the following transactions occurred during 2024 and are not yet reflected in the account balances above: June3June8originallycharged$5,000.Provideadditionalservicesonaccountfor$7,000.Allservicesonaccountincludeterms2/10,n/30.Receivecashfromcustomerswithin10daysoftheservicesbeingprovidedonaccount.Thecustomerswere The following information is available on December 31. a. Estimate that 10\% of the balance of accounts receivable (after transactions in requirement 1) will not be collected. (Hint. Use the January 31 accounts receivable balance calculated in the general ledger to determine the total estimate of uncollectible accounts.) b. Accrue interest on the note receivable of $10,000, which was accepted on October 1,2024 . Interest is due each September 30. Choose the appropriate accounts to complete the company's balance sheet. Make sure to select 'adjusted' from the dropdow then populate the balances in those accounts from the adjusted trial balance. Exercise 5-22 (Static) Complete the accounting cycle using receivable transactions (LO5-1, 5-2, 5-4, 55,57)(GL) The general ledger of Pop's Fireworks includes the following account balances in 2024: In addition, the following transactions occurred during 2024 and are not yet reflected in the account balances above: June3June8originallycharged$5,000.Provideadditionalservicesonaccountfor$7,000.Allservicesonaccountincludeterms2/10,n/30.Receivecashfromcustomerswithin10daysoftheservicesbeingprovidedonaccount.Thecustomerswere The following information is available on December 31. a. Estimate that 10\% of the balance of accounts receivable (after transactions in requirement 1) will not be collected. (Hint. Use the January 31 accounts receivable balance calculated in the general ledger to determine the total estimate of uncollectible accounts.) b. Accrue interest on the note receivable of $10,000, which was accepted on October 1,2024 . Interest is due each September 30. Choose the appropriate accounts to complete the company's balance sheet. Make sure to select 'adjusted' from the dropdow then populate the balances in those accounts from the adjusted trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts