Question: Exercise 5-22 (Static) CVP analysis with two products LO P3 Handy Home sells windows (80% of sales) and doors (20% of sales). The selling price

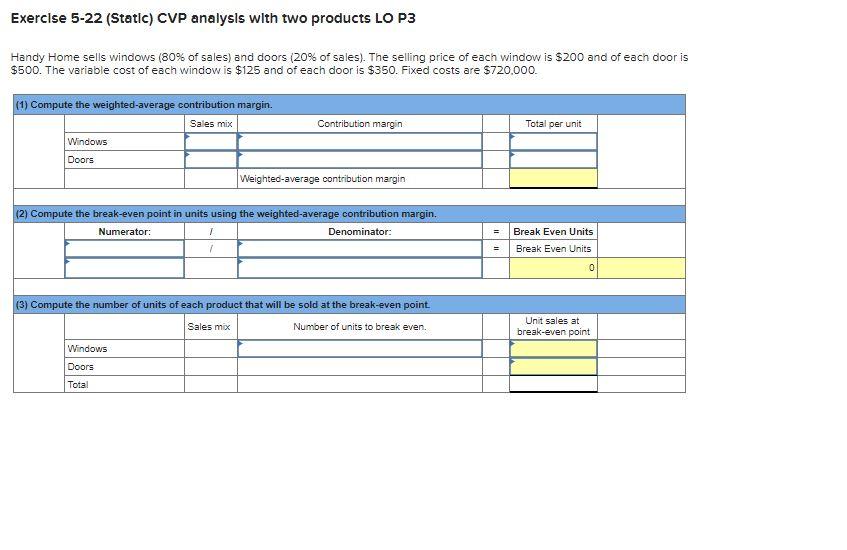

Exercise 5-22 (Static) CVP analysis with two products LO P3 Handy Home sells windows (80% of sales) and doors (20% of sales). The selling price of each window is $200 and of each door is $500. The variable cost of each window is $125 and of each door is $350. Fixed costs are $720,000.

Exercise 5-22 (Static) CVP analysis with two products LO P3 Handy Home sells windows (80% of sales) and doors (20% of sales). The selling price of each window is $200 and of each door is $500. The variable cost of each window is $125 and of each door is $350. Fixed costs are $720,000.

Exercise 5-22 (Static) CVP analysis with two products LO P3 Handy Home sells windows (80% of sales) and doors (20% of sales). The selling price of each window is $200 and of each door is $500. The variable cost of each window is $125 and of each door is $350. Fixed costs are $720.000. (1) Compute the weighted-average contribution margin. Sales mix Contribution margin Total per unit Windows Doors Weighteo-average contribution margin (2) Compute the break-even point in units using the weighted average contribution margin. Numerator: Denominator: 1 1 Break Even Units Break Even Units 0 (3) Compute the number of units of each product that will be sold at the break-even point Sales mix Number of units to break even. Windows Unit sales at break-even point Doors Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts