Question: Exercise 5-3 (Algorithmic) (LO. 3) Stanford owns and operates two dry cleaning businesses. He travels to Boston to discuss acquiring a restaurant. Later in the

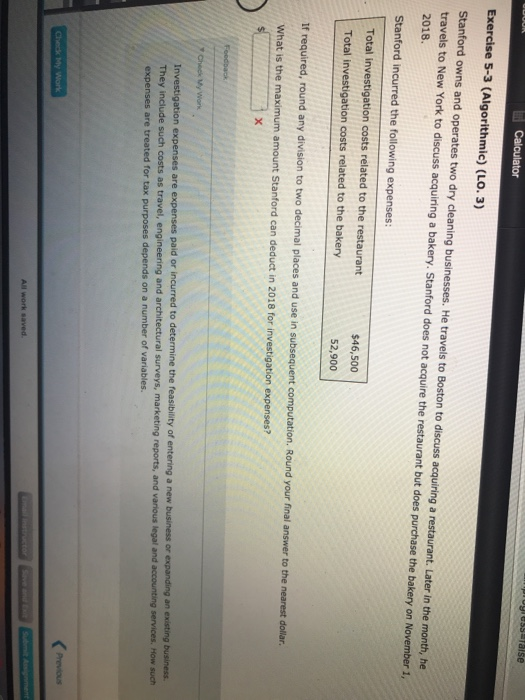

Exercise 5-3 (Algorithmic) (LO. 3) Stanford owns and operates two dry cleaning businesses. He travels to Boston to discuss acquiring a restaurant. Later in the month, he travels to New York to discuss acquiring a bakery. Stanford does not acquire the restaurant but does purchase the bakery on November 1, 2018 Stanford incurred the following expenses: Total investigation costs related to the restaurant $46,500 Total investigation costs related to the bakery 52,900 If required, round any division to two decimal places and use in subsequent computation. Round your final answer to the nearest dollar. What is the maximum amount Stanford can deduct in 2018 for investigation expenses? a new business or expanding an existing business. n expenses are expenses paid or incurred to determine the feasibility of entering l surveys, marketing reports, and various legal and accounting services. How such They include such costs as travel, engineering and architectural expenses are treated for tax purposes depends on a number of variables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts