Question: Exercise 5-6 (Algorithmic) (LO, 7) Hamiet acquires a 7-year class asset on November 2.3,2021, for $138,600 (the only asset acquired during the year), hismler boes

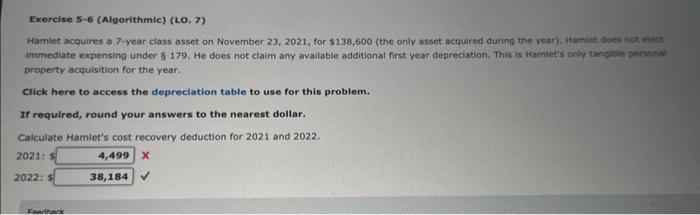

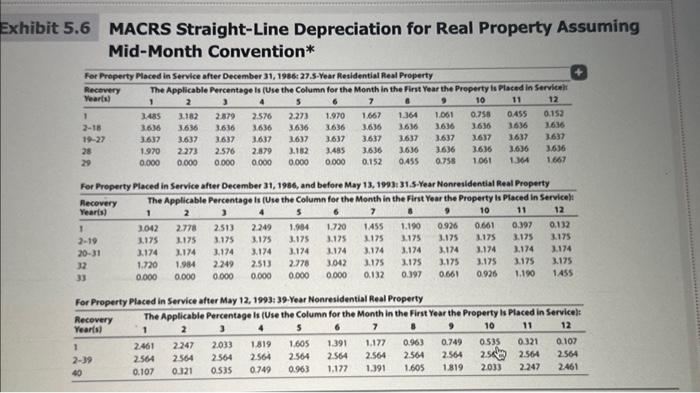

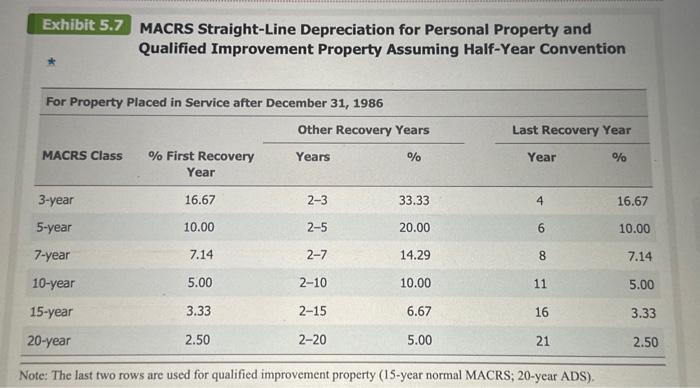

Exercise 5-6 (Algorithmic) (LO, 7) Hamiet acquires a 7-year class asset on November 2.3,2021, for $138,600 (the only asset acquired during the year), hismler boes nck elen immediate expensing under $179. He does not claim any available additional first year depreciation. This is tharnlet's only zangubin persaral property acquisition for the year. click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. Calculate Hamlet's cost recovery deduction for 2021 and 2022. 2021:5 x MACRS Straight-Line Depreciation for Real Property Assuming Mid-Month Convention* MACRS Straight-Line Depreciation for Personal Property and Qualified Improvement Property Assuming Half-Year Convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts