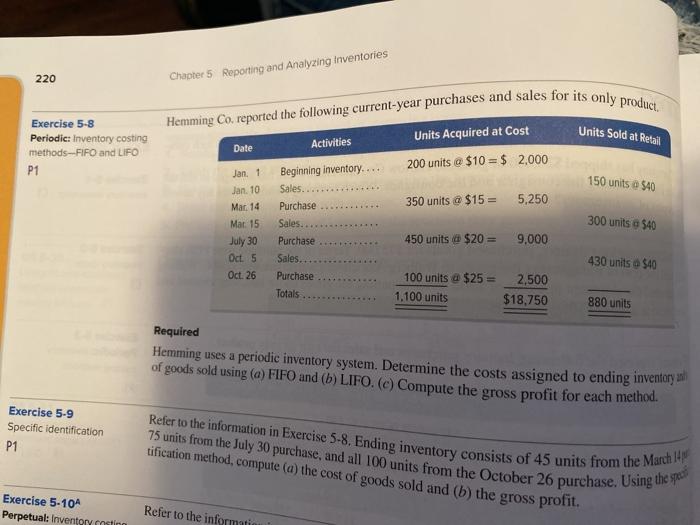

Question: exercise 5-8 220 Chapter 5 Reporting and Analyzing inventories Units Sold at Retail Exercise 5-8 Periodic: Inventory costing methods--FIFO and LIFO P1 150 units o

220 Chapter 5 Reporting and Analyzing inventories Units Sold at Retail Exercise 5-8 Periodic: Inventory costing methods--FIFO and LIFO P1 150 units o $40 Hemming Co. reported the following current-year purchases and sales for its only product. Units Acquired at Cost Date Activities Jan 1 Beginning inventory.... 200 units @ $10 = $ 2,000 Jan. 10 Sales... Purchase Mar 14 5,250 350 units a $15 = Mar. 15 Sales... July 30 Purchase 450 units @ $20 = 9.000 Oct. 5 Sales.. Oct. 26 Purchase 100 units @ $25 = 2,500 Totals 1.100 units $18,750 300 units 9 540 430 units $40 880 units Required of goods sold using (a) FIFO and (b) LIFO. (c) Compute the gross profit for each method. Hemming uses a periodic inventory system. Determine the costs assigned to ending inventory a Exercise 5.9 Specific identification P1 Refer to the information in Exercise 5-8. Ending inventory consists of 45 units from the March 14 75 units from the July 30 purchase, and all 100 units from the October 26 purchase. Using the sper tification method, compute (a) the cost of goods sold and (b) the gross profit. Exercise 5-104 Perpetual: Inventory stinn Refer to the informati

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts