Question: ' EXERCISE 6 . 1 4 Chung University Technology Store ( CUTS ) is a retail computer store in the university center of a large

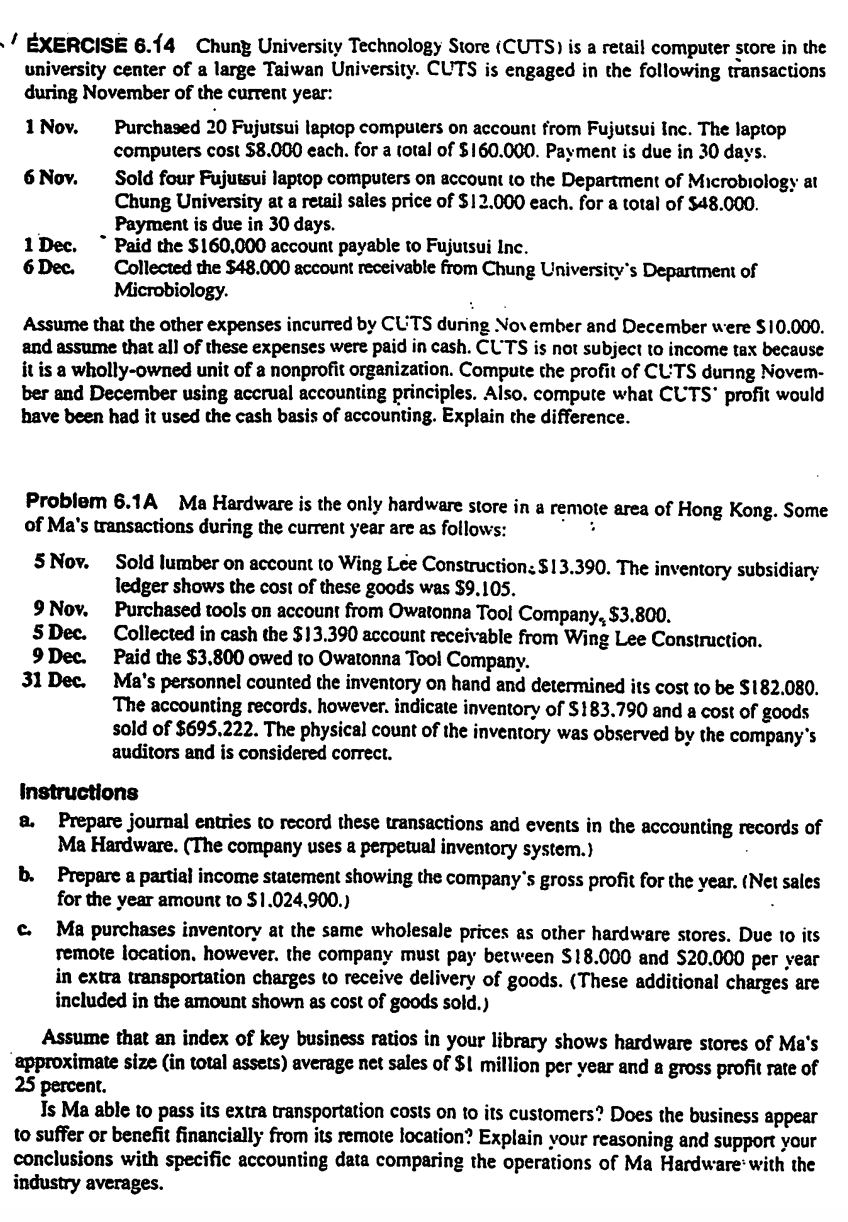

EXERCISE Chung University Technology Store CUTS is a retail computer store in the university center of a large Taiwan University. CUTS is engaged in the following transactions during November of the current year:

Nov. Purchased Fujutsui laptop computers on account from Fujutsui Inc. The laptop computers cost $ each. for a total of $ Payment is due in days.

Nov. Sold four Fujutsui laptop computers on account to the Department of Microbiolog: at Chung University at a retail sales price of $ each. for a total of $ Payment is due in days.

Dec. Paid the $ account payable to Fujutsui Inc.

Dec. Collected the $ account receivable from Chung University's Department of Microbiology.

Assume that the other expenses incurred by CLiTS during. Vov ember and December were $ and assume that all of these expenses were paid in cash. CLTS is not subject to income tax because it is a whollyowned unit of a nonprofit organization. Compute the profit of CL:TS dunng November and December using accrual accounting principles. Also. compute what CLTS profit would have been had it used the cash basis of accounting. Explain the difference.

Problem A Ma Hardware is the only hardware store in a remote area of Hong Kong. Some of Ma's transactions during the current year are as follows:

Nov. Sold lumber on account to Wing Lee Construction; $ The inventory subsidiary ledger shows the cost of these goods was $

Nov. Purchased tools on account from Owatonna Tool Company $

Dec. Collected in cash the $ account receivable from Wing Lee Construction.

Dec. Paid the $ owed to Owatonna Tool Company.

Dee. Ma's personnel counted the inventory on hand and determined its cost to be $ The accounting records. however. indicate inventory of $ and a cost of goods sold of $ The physical count of the inventory was observed by the company's auditors and is considered correct.

Instructions

a Prepare journal entries to record these transactions and events in the accounting records of Ma Hardware. The company uses a perpetual inventory system.

b Prepare a partial income statement showing the company's gross profit for the year. Net sales for the year amount to $

c Ma purchases inventory at the same wholesale prices as other hardware stores. Due to its remote location. however. the company must pay berween $ and $ per year in extra transportation charges to receive delivery of goods. These additional charges are included in the amount shown as cost of goods sold.

Assume that an index of key business ratios in your library shows hardware stores of Ma's approximate size in total assets average net sales of $ million per year and a gross profit rate of percent.

Is Ma able to pass its extra transportation costs on to its customers? Does the business appear to suffer or benefit financially from its remote location? Explain your reasoning and support your conclusions with specific accounting data comparing the operations of Ma Hardware: with the industry averages.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock