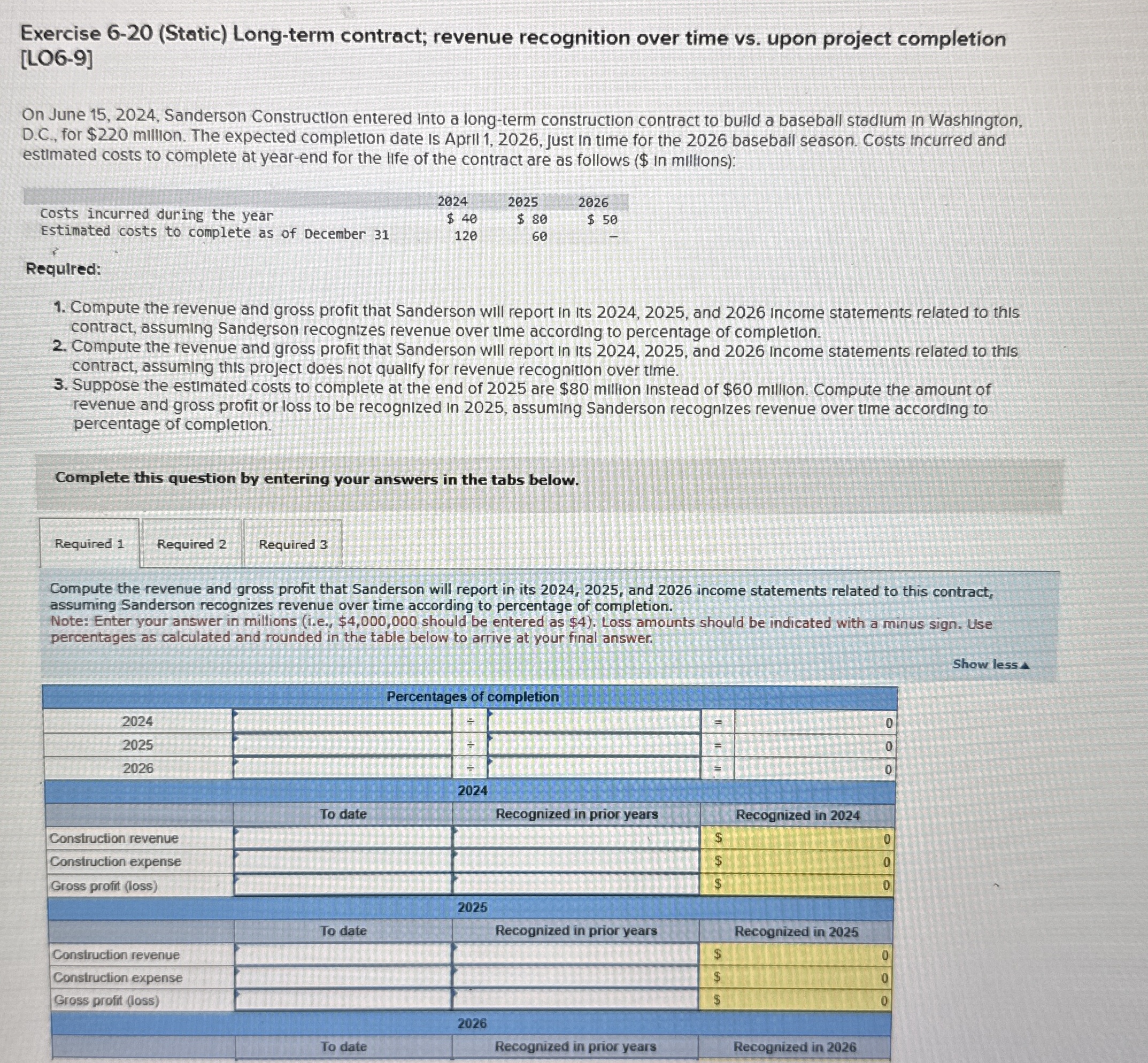

Question: Exercise 6 - 2 0 ( Static ) Long - term contract; revenue recognition over time vs . upon project completion [ LO 6 -

Exercise Static Longterm contract; revenue recognition over time vs upon project completion LO

On June Sanderson Construction entered into a longterm construction contract to build a baseball stadium in Washington, DC for $ million. The expected completion date is April Just in time for the baseball season. Costs incurred and estimated costs to complete at yearend for the life of the contract are as follows $ in millions:

tableCosts incurred during the year,$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock