Question: Exercise 6 - 2 3 ( Algo ) Income ( loss ) recognition; Long - term contract; revenue recognition over time vs . upon project

Exercise Algo Income loss recognition; Longterm contract; revenue recognition over time vs upon project completion LO

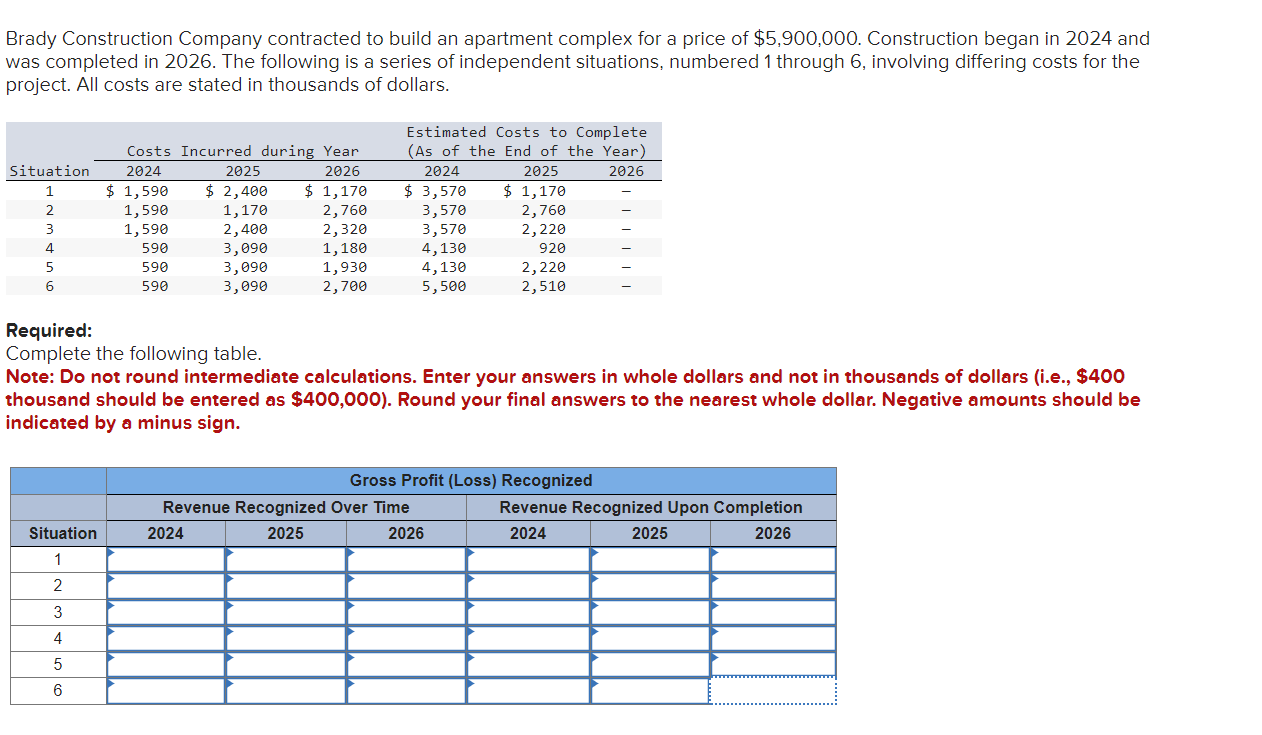

Brady Construction Company contracted to build an apartment complex for a price of $ Construction began in and was completed in The following is a series of independent situations, numbered through involving differing costs for the project. All costs are stated in thousands of dollars. Brady Construction Company contracted to build an apartment complex for a price of $ Construction began in and was completed in The following is a series of independent situations, numbered through involving differing costs for the project. All costs are stated in thousands of dollars.

Required:

Complete the following table.

Note: Do not round intermediate calculations. Enter your answers in whole dollars and not in thousands of dollars ie$ thousand should be entered as $ Round your final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock