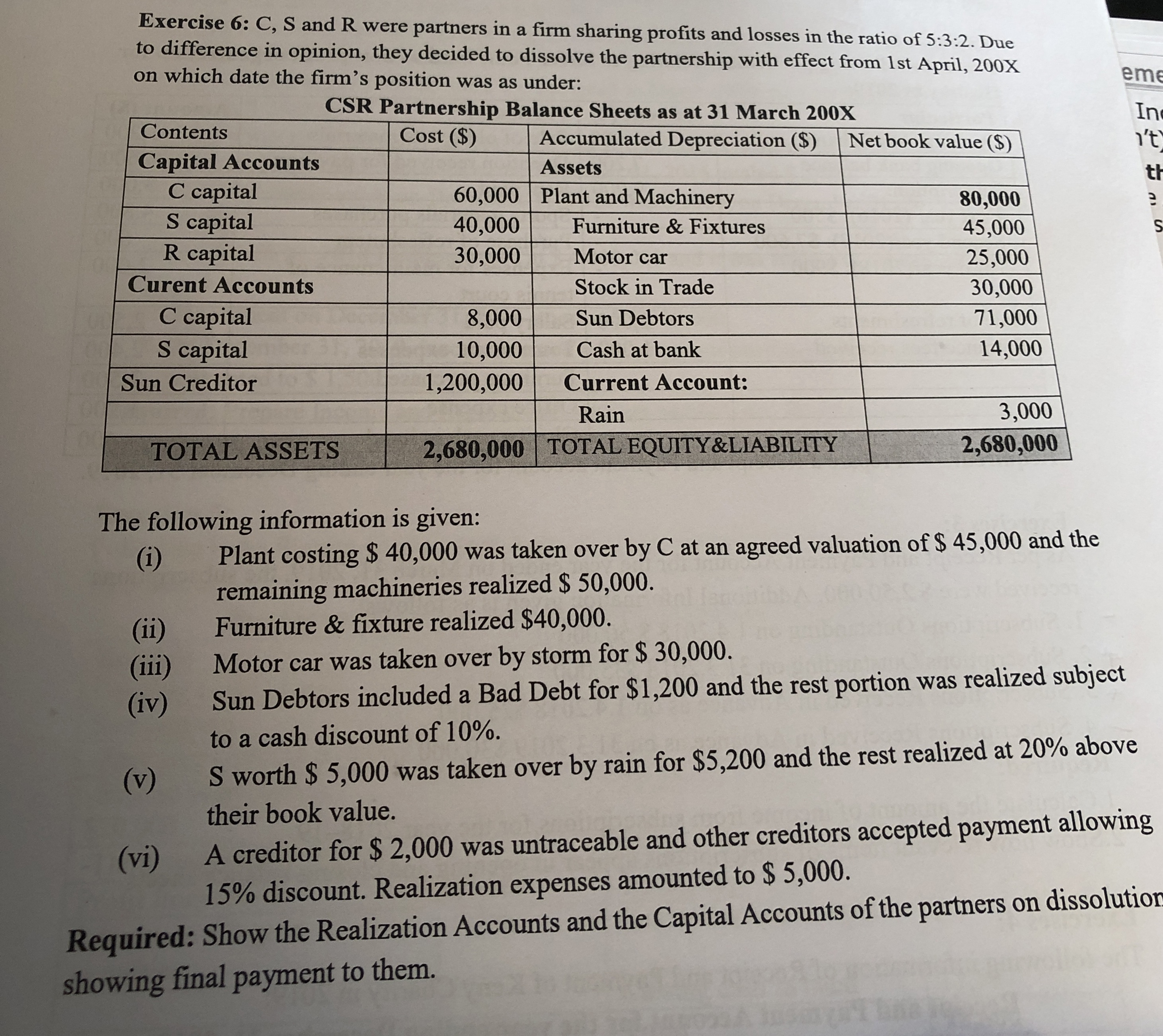

Question: Exercise 6 : C , S and R were partners in a firm sharing profits and losses in the ratio of 5 : 3 :

Exercise : C S and R were partners in a firm sharing profits and losses in the ratio of :: Due

to difference in opinion, they decided to dissolve the partnership with effect from st April, X

on which date the firm's position was as under:

CSR Partnership Balance Sheets as at March X

The following information is given:

i Plant costing $ was taken over by at an agreed valuation of $ and the

remaining machineries realized $

ii Furniture & fixture realized $

iii Motor car was taken over by storm for $

iv Sun Debtors included a Bad Debt for $ and the rest portion was realized subject

to a cash discount of

v S worth $ was taken over by rain for $ and the rest realized at above

their book value.

vi A creditor for $ was untraceable and other creditors accepted payment allowing

discount. Realization expenses amounted to $

Required: Show the Realization Accounts and the Capital Accounts of the partners on dissolution

showing final payment to them.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock