Question: Exercise 6-08 a-d (Part Level Submission) Bramble Corp. had 165 units in beginning inventory at a total cost of $19,800. The company purchased 330 units

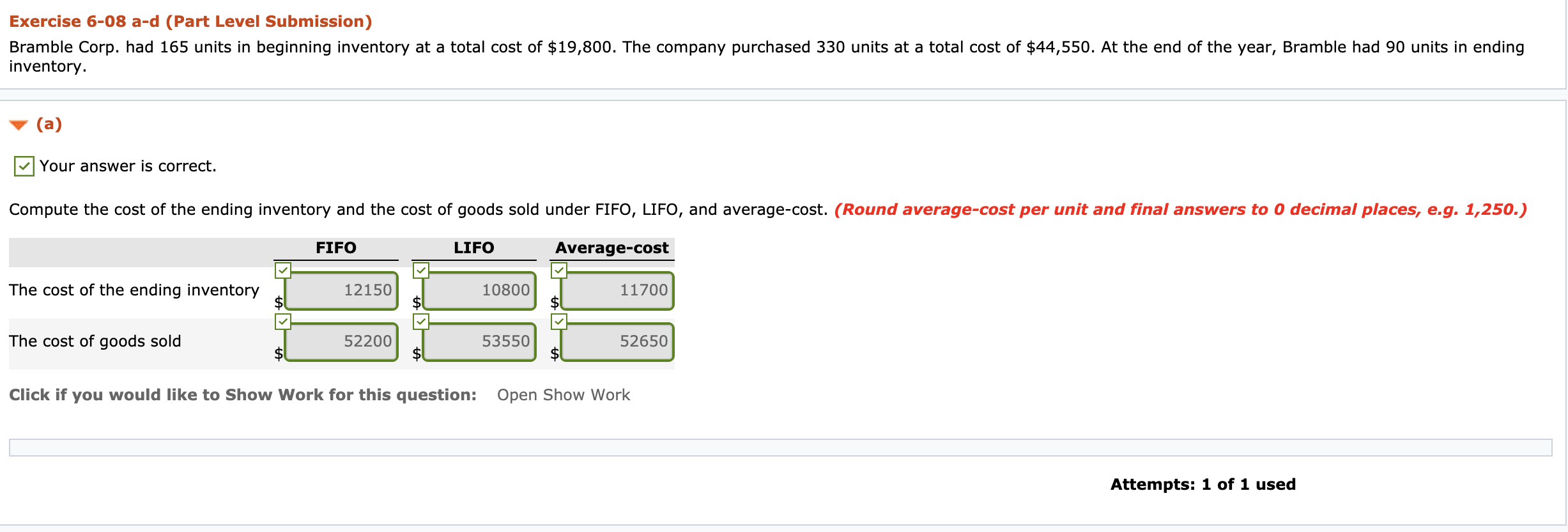

Exercise 6-08 a-d (Part Level Submission) Bramble Corp. had 165 units in beginning inventory at a total cost of $19,800. The company purchased 330 units at a total cost of $44,550. At the end of the year, Bramble had 90 units in ending inventory. (a) Your answer is correct. Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round average-cost per unit and final answers to 0 decimal places, e.g. 1,250.) FIFO LIFO Average-cost The cost of the ending inventory 12150 10800 11700 $ The cost of goods sold 52200 53550 52650 $ Click if you would like to Show Work for this question: Open Show Work Attempts: 1 of 1 used (d) Which cost flow method would result in Bramble paying the least taxes in the first year? Click if you would like to Show Work for this question: Open Show Work Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts