Question: = Exercise 6.1 As we've seen, the Ito integral is defined by sampling the inte grand b = (b) at the left endpoints of each

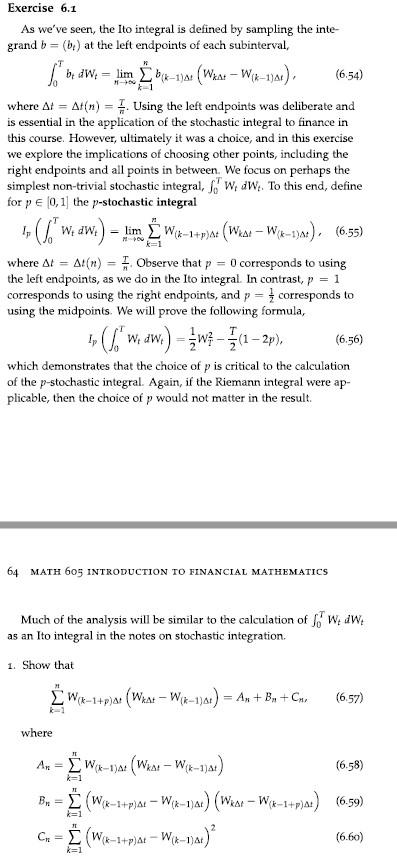

= Exercise 6.1 As we've seen, the Ito integral is defined by sampling the inte grand b = (b) at the left endpoints of each subinterval, fob, dW. = lim b4-1994 (Wass Wix-11). (6.54) where At = f(n) = Using the left endpoints was deliberate and is essential in the application of the stochastic integral to finance in this course. However, ultimately it was a choice, and in this exercise we explore the implications of choosing other points, including the right endpoints and all points in between We focus on perhaps the simplest non-trivial stochastic integral, ('w dw.. To this end, define for p = [0,1] the p-stochastic integral ( W, aw:) + - lim LWx-1+r)(Wkst - Wik-1)t)(6.55) where At A!(n) = Observe that p = 0 corresponds to using the left endpoints, as we do in the Ito integral In contrast, p = 1 corresponds to using the right endpoints, and p = } corresponds to using the midpoints. We will prove the following formula, (SWJW;) - {w} - {(12p), - { (6.56) which demonstrates that the choice of p is critical to the calculation of the p-stochastic integral. Again, if the Riemann integral were ap- plicable, then the choice of p would not matter in the result. k=1 64 MATH 605 INTRODUCTION TO FINANCIAL MATHEMATICS Much of the analysis will be similar to the calculation of f' W dw, as an Ito integral in the notes on stochastic integration 1. Show that Wax-1+par (Wane - Wix-1708) = An + Bu + Come (6.57) where 1 (6.58) k=1 IT Arx1A (Wkar - Wx-1)41) Br = (Wie=1+plar Wix-1)ar) (Wear Wx=1+pyar) (6.59) Cu = (W-4+p) Wix-1)ar) (w-1 k}at } + ) k=1 (6.60) k=1 = Exercise 6.1 As we've seen, the Ito integral is defined by sampling the inte grand b = (b) at the left endpoints of each subinterval, fob, dW. = lim b4-1994 (Wass Wix-11). (6.54) where At = f(n) = Using the left endpoints was deliberate and is essential in the application of the stochastic integral to finance in this course. However, ultimately it was a choice, and in this exercise we explore the implications of choosing other points, including the right endpoints and all points in between We focus on perhaps the simplest non-trivial stochastic integral, ('w dw.. To this end, define for p = [0,1] the p-stochastic integral ( W, aw:) + - lim LWx-1+r)(Wkst - Wik-1)t)(6.55) where At A!(n) = Observe that p = 0 corresponds to using the left endpoints, as we do in the Ito integral In contrast, p = 1 corresponds to using the right endpoints, and p = } corresponds to using the midpoints. We will prove the following formula, (SWJW;) - {w} - {(12p), - { (6.56) which demonstrates that the choice of p is critical to the calculation of the p-stochastic integral. Again, if the Riemann integral were ap- plicable, then the choice of p would not matter in the result. k=1 64 MATH 605 INTRODUCTION TO FINANCIAL MATHEMATICS Much of the analysis will be similar to the calculation of f' W dw, as an Ito integral in the notes on stochastic integration 1. Show that Wax-1+par (Wane - Wix-1708) = An + Bu + Come (6.57) where 1 (6.58) k=1 IT Arx1A (Wkar - Wx-1)41) Br = (Wie=1+plar Wix-1)ar) (Wear Wx=1+pyar) (6.59) Cu = (W-4+p) Wix-1)ar) (w-1 k}at } + ) k=1 (6.60) k=1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts