Question: Exercise 6.13 A select life aged 45 purchases a single premium deferred annuity which provides an annuity of $40 000 per year, payable annually in

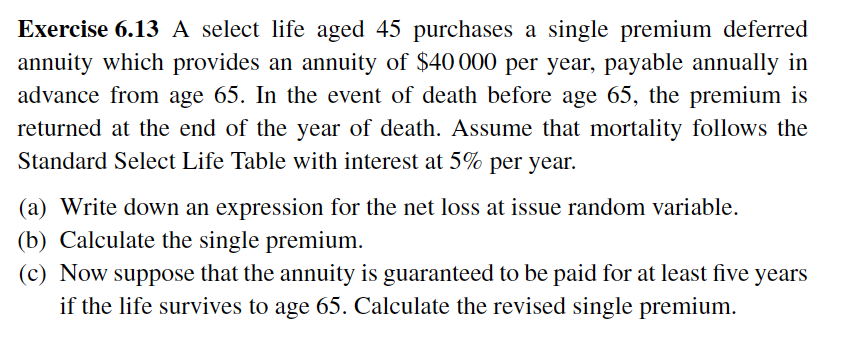

Exercise 6.13 A select life aged 45 purchases a single premium deferred annuity which provides an annuity of $40 000 per year, payable annually in advance from age 65. In the event of death before age 65, the premium is returned at the end of the year of death. Assume that mortality follows the Standard Select Life Table with interest at 5% per year. (a) Write down an expression for the net loss at issue random variable. (b) Calculate the single premium. (c) Now suppose that the annuity is guaranteed to be paid for at least five years if the life survives to age 65. Calculate the revised single premium. Exercise 6.13 A select life aged 45 purchases a single premium deferred annuity which provides an annuity of $40 000 per year, payable annually in advance from age 65. In the event of death before age 65, the premium is returned at the end of the year of death. Assume that mortality follows the Standard Select Life Table with interest at 5% per year. (a) Write down an expression for the net loss at issue random variable. (b) Calculate the single premium. (c) Now suppose that the annuity is guaranteed to be paid for at least five years if the life survives to age 65. Calculate the revised single premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts