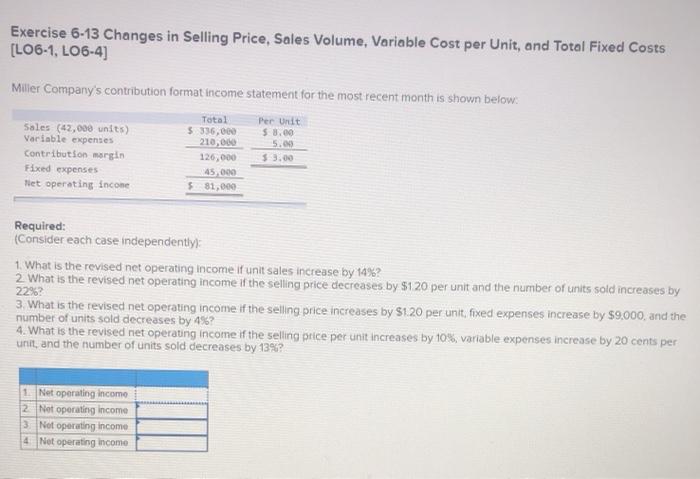

Question: Exercise 6-13 Changes in Selling Price, Sales Volume, Variable Cost per Unit, and Total Fixed Costs [LO6-1, L06-4) Miller Company's contribution format income statement for

Exercise 6-13 Changes in Selling Price, Sales Volume, Variable Cost per Unit, and Total Fixed Costs [LO6-1, L06-4) Miller Company's contribution format income statement for the most recent month is shown below: Per Unit $ 3.00 5.00 Sales (42,000 units) Variable expenses Contribution margin Fixed expenses Tiet operating income Total 5 336.000 210,00 120,000 45,000 $81,000 Required: (Consider each case independently 1. What is the revised net operating income if unt sales increase by 14%? 2 What is the revised net operating income if the selling price decreases by $120 per unit and the number of units sold increases by 22%? 3. What is the revised net operating income if the selling price increases by S1 20 per unit, fixed expenses increase by $9.000, and the number of units sold decreases by 495? 4. What is the revised net operating income if the selling price per unit increases by 10%, variable expenses increase by 20 cents per unit, and the number of units sold decreases by 13%? 1. Net operating income 2 Net operating income 3. Not operating income 4 Not operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts