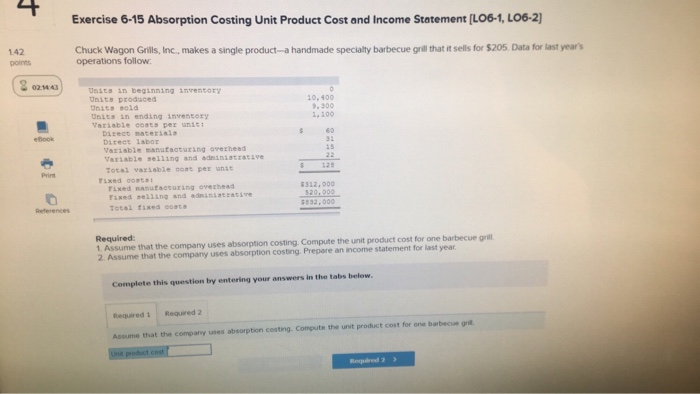

Question: Exercise 6-15 Absorption Costing Unit Product Cost and Income Statement [LO6-1, LO6-2] 142 points Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue

Exercise 6-15 Absorption Costing Unit Product Cost and Income Statement [LO6-1, LO6-2] 142 points Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $205. Data for last years operations follow 0214 43 Units in beginning inventory Units produced Units sold Units in ending inrentory Variable costs per unst 10-400 9.300 1,100 Direct maceriai Direet labor Variable manutacturing ovezhead Variable selling and adeiniatzaesve 15 5 128 312,000 32,000 Total varsable coat per unst Print Fixed dosts rixed manufacturing overhead Fixed selling and admanaczative Total fixed costs References Required: 1 Assume that the company uses absorption costing. Compute the unit product cost for one barbecue gril 2. Assume that the company uses absorption costing Prepare an income statement for last year Complete this question by entering your answers in the tabs below Required1 Required 2 Assume that the company uses absorption costing Compute the unst product cost for one barbecue gri

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts