Question: Exercise 6-16 (Static) Target pricing LO P3 Huds Incorporated reports the information below on its product. The company uses absorption costing and has a target

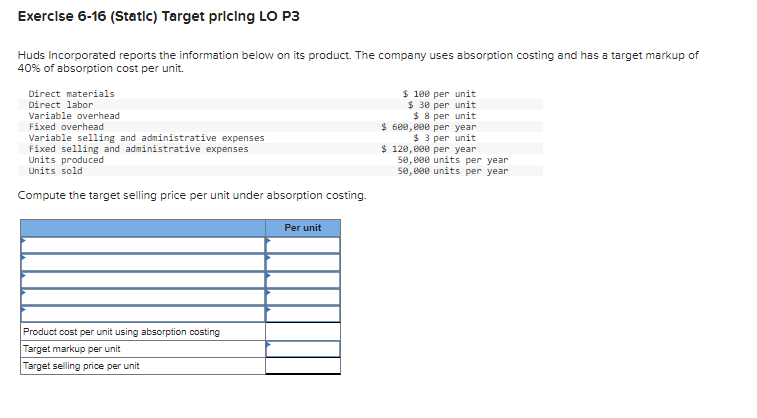

Exercise 6-16 (Static) Target pricing LO P3

Huds Incorporated reports the information below on its product. The company uses absorption costing and has a target markup of 40% of absorption cost per unit.

| Direct materials | $ 100 | per unit |

|---|---|---|

| Direct labor | $ 30 | per unit |

| Variable overhead | $ 8 | per unit |

| Fixed overhead | $ 600,000 | per year |

| Variable selling and administrative expenses | $ 3 | per unit |

| Fixed selling and administrative expenses | $ 120,000 | per year |

| Units produced | 50,000 | units per year |

| Units sold | 50,000 | units per year |

Compute the target selling price per unit under absorption costing.

Exercise 6-16 (Static) Target pricing LO P3 Huds Incorporated reports the information below on its product. The company uses absorption costing and has a target markup of 40% of absorption cost per unit. Direct materials $ 108 per unit Direct labor $ 30 per unit Variable overhead $ 8 per unit Fixed overhead $ 600, 200 per year Variable selling and administrative expenses $ 3 per unit Fixed selling and administrative expenses $ 120, 808 per year Units produced 50,coe units per year Units sold 50, 20e units per year Compute the target selling price per unit under absorption costing. Per unit Product cost per unit using absorption costing Target markup per unit Target selling price per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts