Question: Exercise 6-2 (Algo) Variable Costing Income Statement; Explanation of Difference in Net Operating Income [LO6-2] Ida Company produces a handcrafted musical instrument called a gamelan

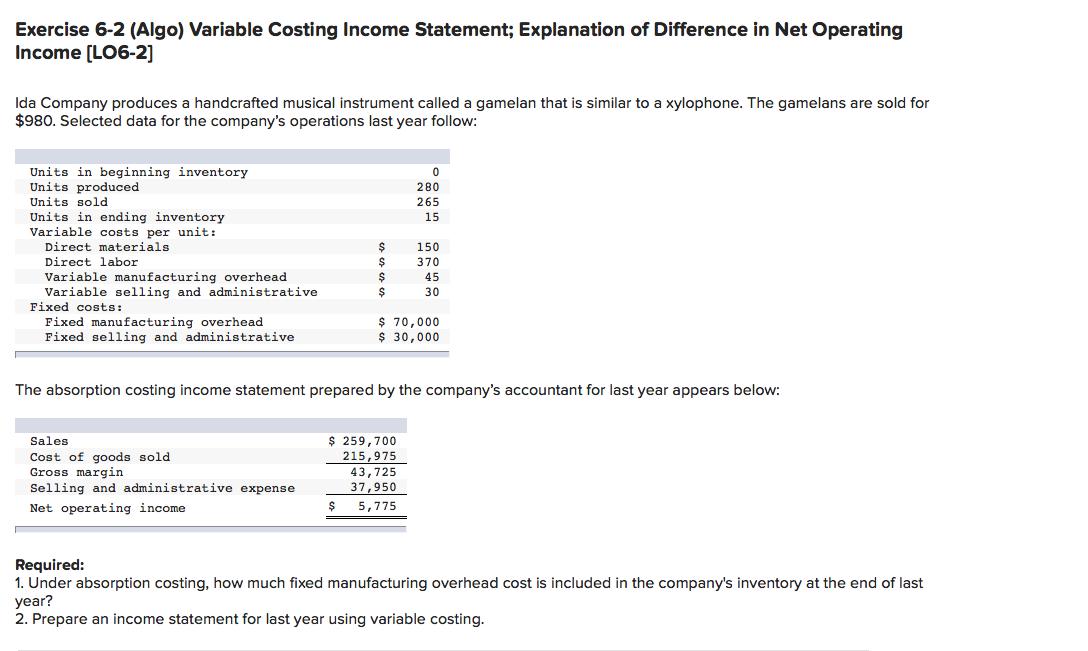

Exercise 6-2 (Algo) Variable Costing Income Statement; Explanation of Difference in Net Operating Income [LO6-2]

Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $980. Selected data for the companys operations last year follow:

| Units in beginning inventory | 0 | |

| Units produced | 280 | |

| Units sold | 265 | |

| Units in ending inventory | 15 | |

| Variable costs per unit: | ||

| Direct materials | $ | 150 |

| Direct labor | $ | 370 |

| Variable manufacturing overhead | $ | 45 |

| Variable selling and administrative | $ | 30 |

| Fixed costs: | ||

| Fixed manufacturing overhead | $ | 70,000 |

| Fixed selling and administrative | $ | 30,000 |

The absorption costing income statement prepared by the companys accountant for last year appears below:

| Sales | $ | 259,700 |

| Cost of goods sold | 215,975 | |

| Gross margin | 43,725 | |

| Selling and administrative expense | 37,950 | |

| Net operating income | $ | 5,775 |

Required:

1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year?

2. Prepare an income statement for last year using variable costing.

Exercise 6-2 (Algo) Variable Costing Income Statement; Explanation of Difference in Net Operating Income (LO6-2] Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $980. Selected data for the company's operations last year follow: 0 280 265 15 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs: Fixed manufacturing overhead Fixed selling and administrative $ $ $ $ 150 370 45 30 $ 70,000 $ 30,000 The absorption costing income statement prepared by the company's accountant for last year appears below: Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income $ 259,700 215,975 43,725 37,950 $ 5,775 Required: 1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. Prepare an income statement for last year using variable costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts