Question: Exercise 6-28 (Algorithmic) (LO. 2) Meghan, a calendar year taxpayer, is the owner of a sole proprietorship that uses the cash method. On February 1,

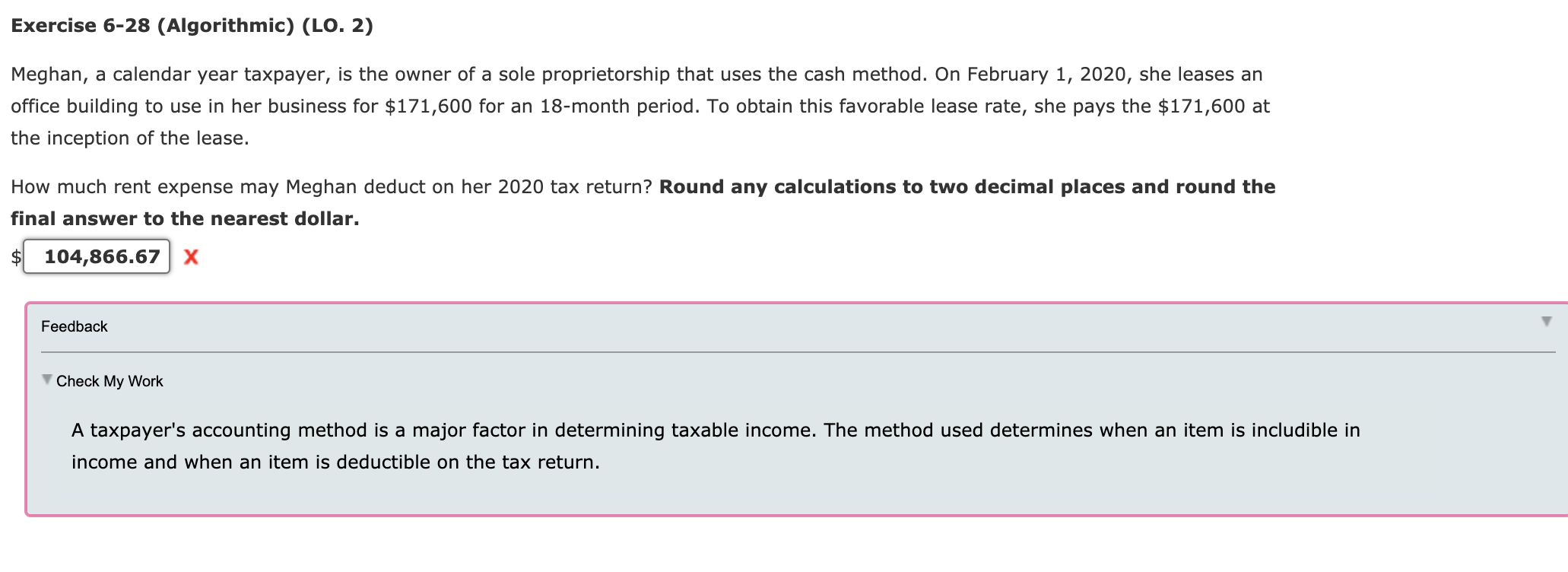

Exercise 6-28 (Algorithmic) (LO. 2) Meghan, a calendar year taxpayer, is the owner of a sole proprietorship that uses the cash method. On February 1, 2020, she leases an office building to use in her business for $171,600 for an 18-month period. To obtain this favorable lease rate, she pays the $171,600 at the inception of the lease. How much rent expense may Meghan deduct on her 2020 tax return? Round any calculations to two decimal places and round the final answer to the nearest dollar. 104,866.67 X Feedback Check My Work A taxpayer's accounting method is a major factor in determining taxable income. The method used determines when an item is includible in income and when an item is deductible on the tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts