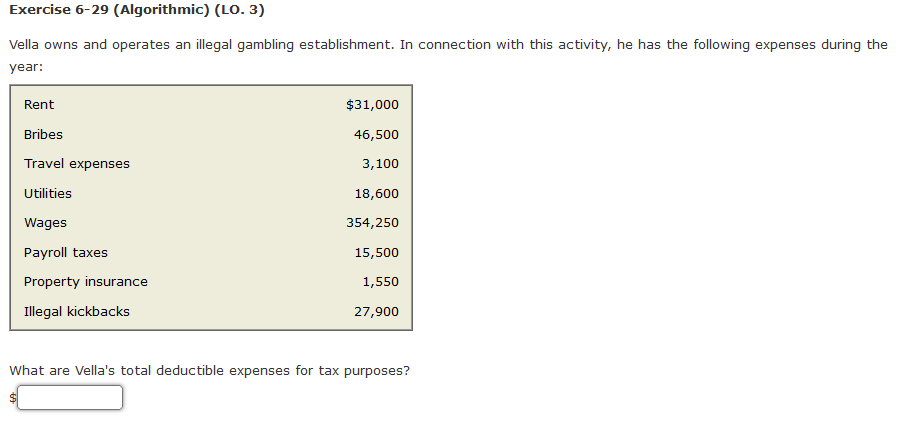

Question: Exercise 6-29 (Algorithmic) (LO. 3) Vella owns and operates an illegal gambling establishment. In connection with this activity, he has the following expenses during the

Exercise 6-29 (Algorithmic) (LO. 3) Vella owns and operates an illegal gambling establishment. In connection with this activity, he has the following expenses during the year: Rent $31,000 Bribes 46,500 Travel expenses 3,100 Utilities 18,600 Wages 354,250 15,500 Payroll taxes Property insurance Illegal kickbacks 1,550 27,900 What are Vella's total deductible expenses for tax purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts