Question: Exercise 6-3 FI FO and 6-4 LIFO (p. 301 ) for each one do part a ONLY and also indicate the total for April 19h

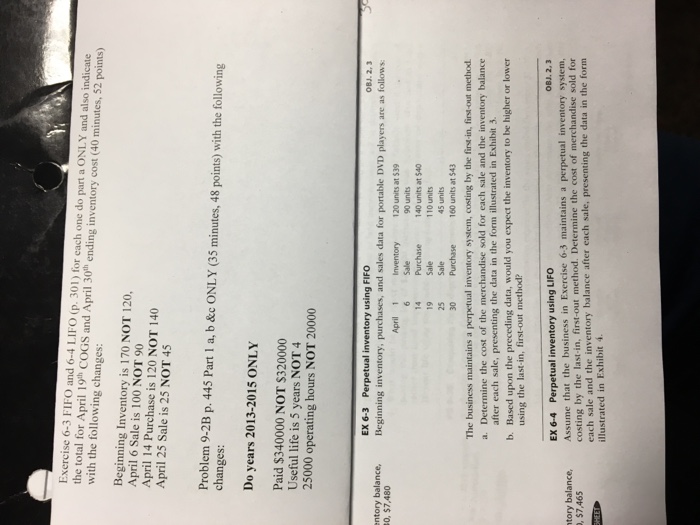

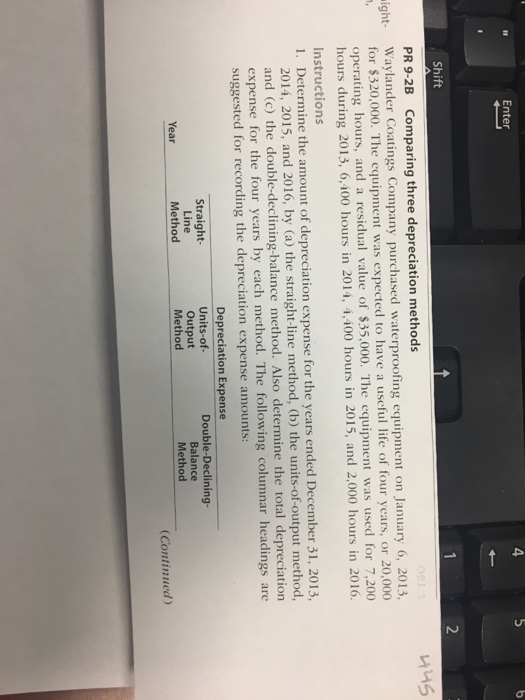

Exercise 6-3 FI FO and 6-4 LIFO (p. 301 ) for each one do part a ONLY and also indicate the total for April 19h COGS and April 30th ending inventory cost (40 minutes, 52 points) with the following changes: Beginning Inventory is 170 NOT 120, April 6 Sale is 100 NOT 90 April 14 Purchase is 120 NOT 140 April 25 Sale is 25 NOT 45 Problem 9-2B p. 445 Part 1 a, b &c ONLY (35 minutes, 48 points) with the following changes: Do years 2013-2015 ONLY Paid $340000 NOT S320000 Useful life is 5 years NOT 4 25000 operating hours NOT 20000 EX 6-3 Perpetual inventory using FIFO OBJ. 2, 3 intory balance, Beginning inventory, purchases, and sales data for portable DVD players are as follows 0, $7,480 April 1 Inventory 120 units at $39 6 Sale 14 Purchase 19 Sae 90 units 140 units at $40 110 units 25 Sale 30 Purchase 160 units at $43 45 units The business maintains a perpetual inventory system, costing by the first-in, first-out methoxd a. Determine the cost of the merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. b. Based upon the preceding data, would you expect the inventory to be higher or lower using the last-in, first-out method? OBJ. 2, 3 EX 6-4 Perpetual inventory using LIFO Assume that the business in Exercise 6-3 maintains a perpetual inventory system costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4 tory balance, , $7,465

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts