Question: Exercise 6-32 (Algorithmic) (10. 4) Pursuant to a complete liquidation, Carrot Corporation distributes to its shareholders real estate held as an investment (basis of $1,199,200,

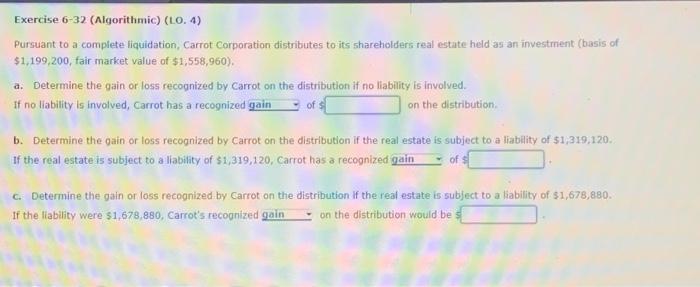

Exercise 6-32 (Algorithmic) (10. 4) Pursuant to a complete liquidation, Carrot Corporation distributes to its shareholders real estate held as an investment (basis of $1,199,200, fair market value of $1,558,960). a. Determine the gain or loss recognized by Carrot on the distribution if no liability is involved. If no liability is involved, Carrot has a recognized on the distribution. b. Determine the gain or loss recognized by Carrot on the distribution if the real estate is subject to a liablity of $1,319,120. If the real estate is subject to a liability of $1,319,120, Carrot has a recognized of $ c. Determine the gain or loss recognized by Carrot on the distribution if the real estate is subject to a liability of $1,678,880. If the liability were $1,678,880, Carrot's recounized on the distribution would be 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts