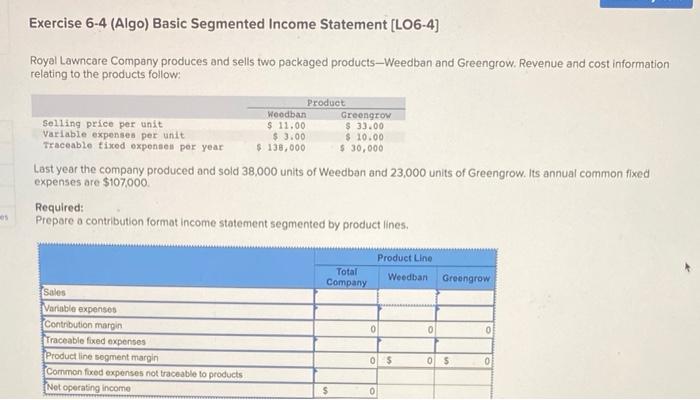

Question: Exercise 6-4 (Algo) Basic Segmented Income Statement (L06-4) Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to

Exercise 6-4 (Algo) Basic Segmented Income Statement (L06-4) Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Woodban Greengrow Selling price per unit $ 11.00 $ 33.00 Variable expenses per unit $ 3.00 $ 10.00 Traceable tixed expenses per year $ 138,000 $ 30,000 Last year the company produced and sold 38,000 units of Weedban and 23,000 units of Greengrow. Its annual common fixed expenses are $107000 Required: Prepare a contribution format Income statement segmented by product lines. Product Line Total Company Weedban Greengrow 0 0 0 Sales Variable expenses (Contribution margin Traceable fixed expenses Product line segment margin Common foxed expenses not traceable to products Net operating income 0 $ 05 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts