Question: Exercise 6-4 (Algo) Basic Segmented Income Statement [LO6-4] Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating

![Exercise 6-4 (Algo) Basic Segmented Income Statement [LO6-4] Royal Lawncare Company produces](https://s3.amazonaws.com/si.experts.images/answers/2024/05/6652e00b0b6b1_3396652e00b020cd.jpg)

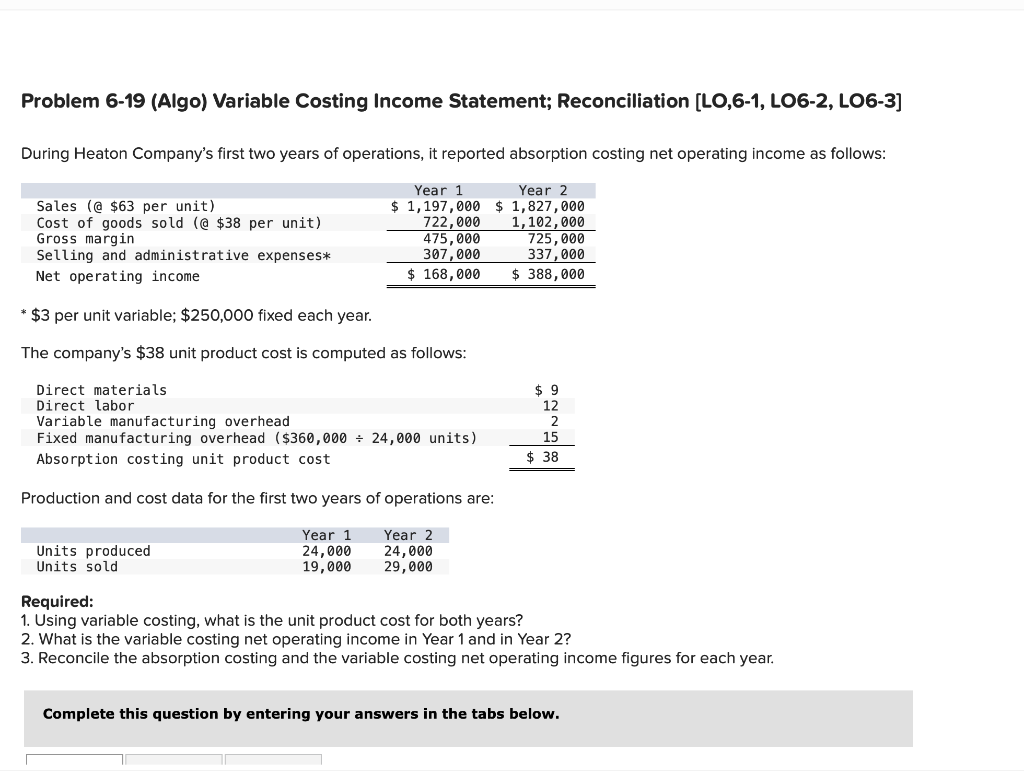

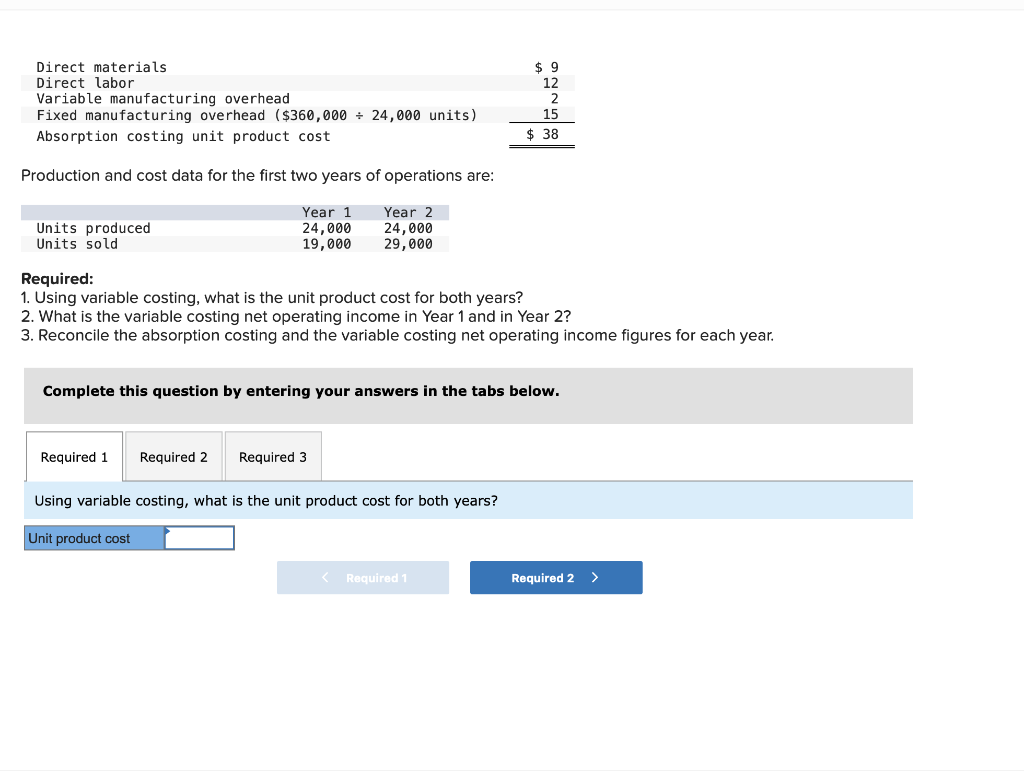

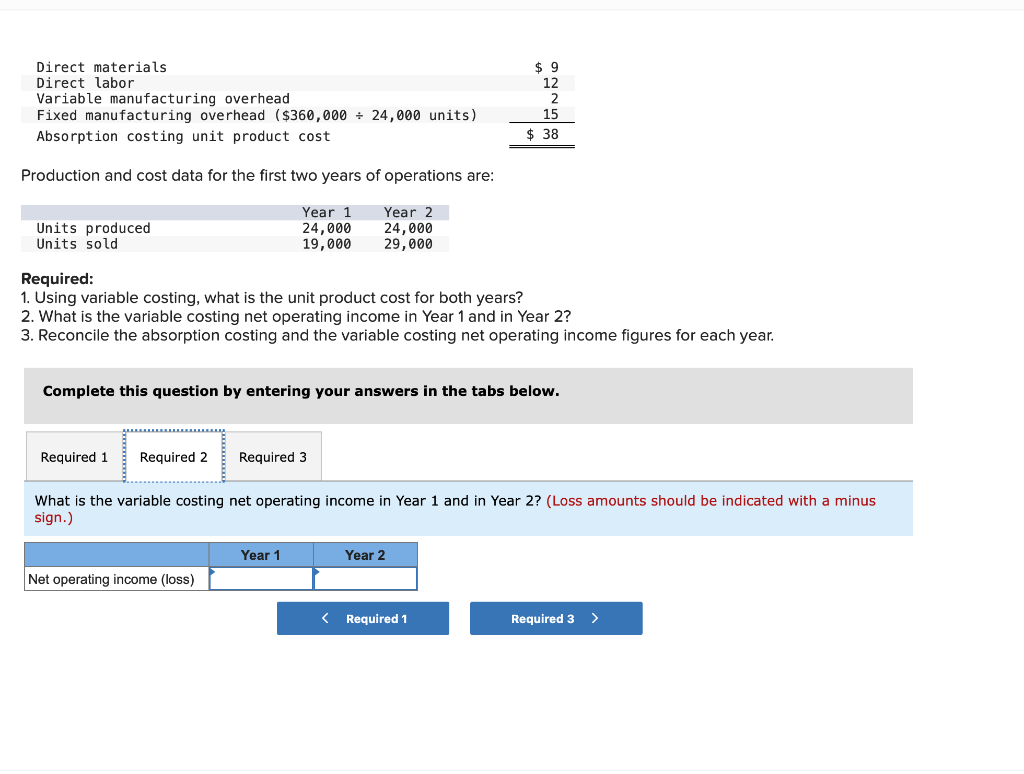

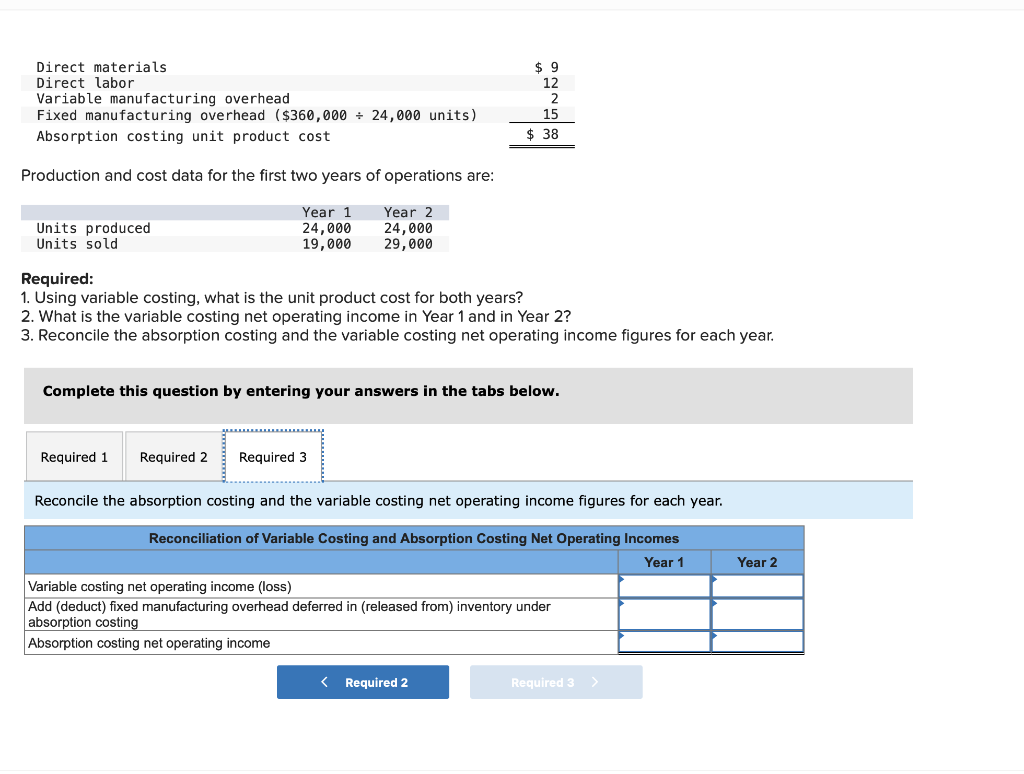

Exercise 6-4 (Algo) Basic Segmented Income Statement [LO6-4] Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Selling price per unit Weedban $ 10.00 Greengrow $ 34.00 Variable expenses per unit $ 2.70 Traceable fixed expenses per year $ 131,000 $ 12.00 $ 40,000 Last year the company produced and sold 36,000 units of Weedban and 15,500 units of Greengrow. Its annual common fixed expenses are $112,000. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Company Weedban Greengrow Problem 6-19 (Algo) Variable Costing Income Statement; Reconciliation [LO,6-1, LO6-2, LO6-3] During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Sales (@ $63 per unit) Cost of goods sold (@ $38 per unit) Gross margin Selling and administrative expenses* Year 1 $ 1,197,000 722,000 475,000 307,000 Year 2 $ 1,827,000 1,102,000 725,000 337,000 Net operating income * $3 per unit variable; $250,000 fixed each year. $ 168,000 $ 388,000 The company's $38 unit product cost is computed as follows: Direct labor Direct materials Variable manufacturing overhead Fixed manufacturing overhead ($360,000 24,000 units) Absorption costing unit product cost $ 9 12 2 15 $ 38 Production and cost data for the first two years of operations are: Year 1 Year 2 Units produced Units sold Required: 24,000 24,000 19,000 29,000 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($360,000 24,000 units) Absorption costing unit product cost $ 9 12 2 15 $ 38 Production and cost data for the first two years of operations are: Year 1 Year 2 Units produced Units sold 24,000 24,000 19,000 29,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using variable costing, what is the unit product cost for both years? Unit product cost < Required 1 Required 2 > Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($360,000 24,000 units) Absorption costing unit product cost $ 9 12 2 15 $ 38 Production and cost data for the first two years of operations are: Year 1 Year 2 Units produced Units sold 24,000 24,000 19,000 29,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the variable costing net operating income in Year 1 and in Year 2? (Loss amounts should be indicated with a minus sign.) Year 1 Year 2 Net operating income (loss) < Required 1 Required 3 > Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($360,000 24,000 units) Absorption costing unit product cost $ 9 12 2 15 $ 38 Production and cost data for the first two years of operations are: Year 1 Year 2 Units produced Units sold 24,000 24,000 19,000 29,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Reconcile the absorption costing and the variable costing net operating income figures for each year. Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income < Required 2 Required 3 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts