Question: Exercise 6-4 Variable costing income statement LO P2 Kenzi Kayaking, a manufacturer of kayaks, began operations this year. During this first year, the company produced

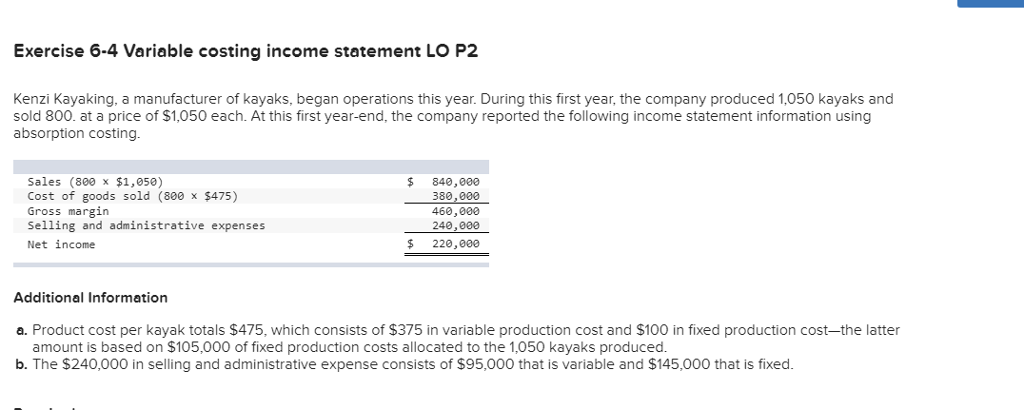

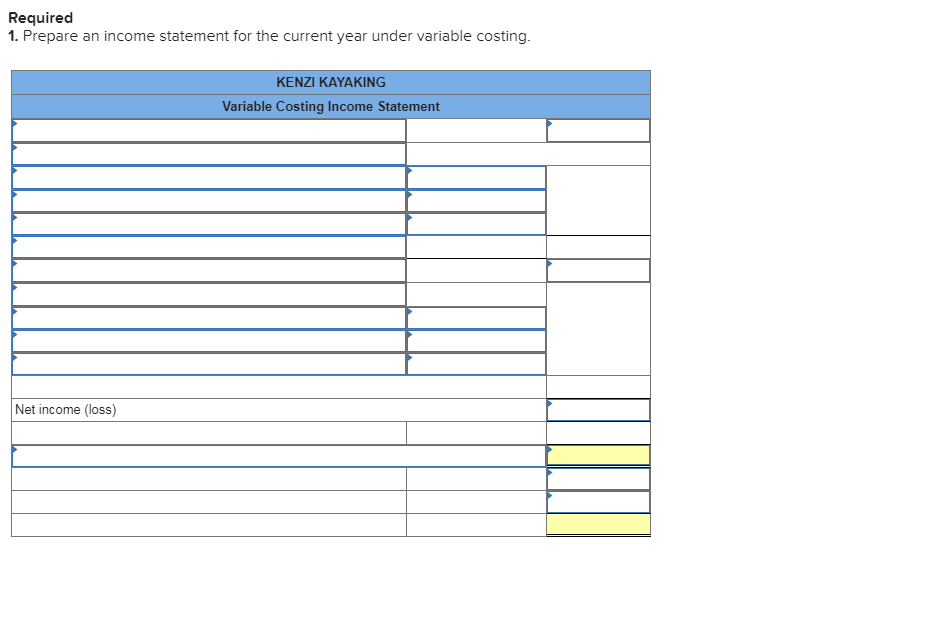

Exercise 6-4 Variable costing income statement LO P2 Kenzi Kayaking, a manufacturer of kayaks, began operations this year. During this first year, the company produced 1,050 kayaks and sold 800. at a price of $1,050 each. At this first year-end, the company reported the following income statement information using absorption costing. Sales (800 x $1,950) Cost of goods sold (800 x $475) Gross margin Selling and administrative expenses Net income $840,000 380,000 460,000 240,000 $ 220,000 Additional Information a. Product cost per kayak totals $475, which consists of $375 in variable production cost and $100 in fixed production cost-the latter amount is based on $105,000 of fixed production costs allocated to the 1,050 kayaks produced b. The $240,000 in selling and administrative expense consists of $95,000 that is variable and $145,000 that is fixed. Required 1. Prepare an income statement for the current year under variable costing KENZI KAYAKING Variable Costing Income Statement Net income (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts