Question: Exercise 6-51 Inventory Costing Methods On June 1, Welding Products Company had a beginning inventory of 210 cases of welding rods that had been purchased

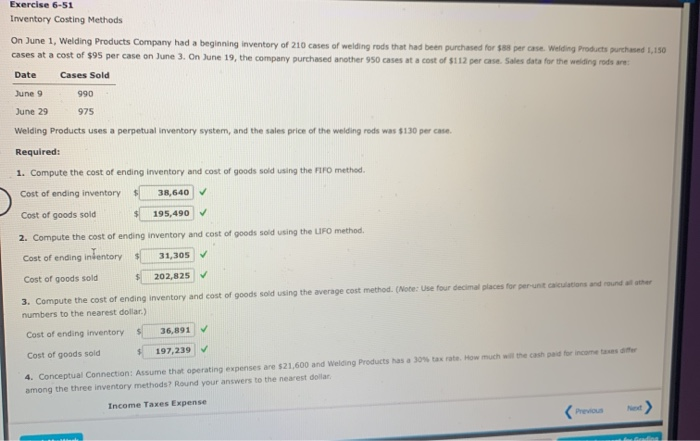

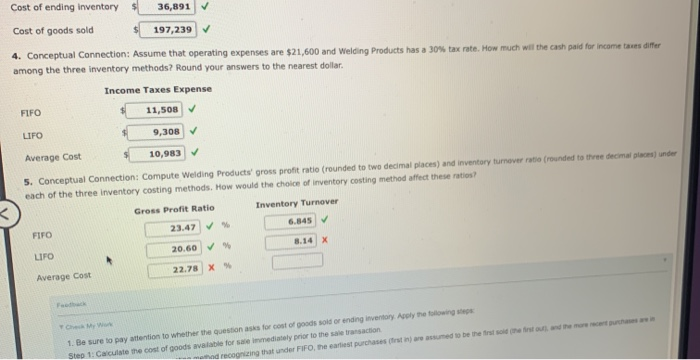

Exercise 6-51 Inventory Costing Methods On June 1, Welding Products Company had a beginning inventory of 210 cases of welding rods that had been purchased for $58 per case. Welding Products purchased 1,150 cases at a cost of $95 per case on June 3. On June 19, the company purchased another 950 cases at a cost of $112 per case. Soles data for the welding rods are: Date Cases Sold June 9 990 June 29 975 Welding Products uses a perpetual Inventory system, and the sales price of the welding rods was $130 per case Required: 1. Compute the cost of ending inventory and cost of goods sold using the FIFO method. Cost of ending inventory $ 38,640 Cost of goods sold $ 195,490 2. Compute the cost of ending inventory and cost of goods sold using the LIFO method. Cost of ending inventory $ 31,305 Cost of goods sold $ 202,825 3. Compute the cost of ending inventory and cost of goods sold using the average cost method. (Note: Use four decimal places for perunt calculations and round numbers to the nearest dollar.) Cost of ending inventory S 36,891 Cost of goods sold $ 197,239 the cash and for come s 4. Conceptual Connection: Assume that operating expenses are $21,600 and Welding Products has a 30% tax rate. How much among the three inventory methods? Round your answers to the nearest dollar Income Taxes Expense Previous Next Cost of ending inventory $ 36,891 Cost of goods sold $ 197,239 4. Conceptual Connection: Assume that operating expenses are $21,600 and Welding Products has a 30% tax rate. How much will the cash paid for income tans differ among the three inventory methods? Round your answers to the nearest dollar. Income Taxes Expense $ 11,508 FIFO LIFO $ 9,308 Average Cost $ 10.983 5. Conceptual Connection: Compute Welding Products' gross profit ratio (rounded to two decimal places) and inventory turnover ratio (rounded to the decimal places under each of the three inventory costing methods. How would the choice of inventory costing method affect these ratios? Gross Profit Ratio Inventory Turnover 23.47 FIFO 20.60 LIFO 22.78 Average cost f the more recent 1. Be sure to pay attention to whether the question asks for cost of goods sold or ending inventory Arly the following Step 1: Calculate the cost of goods available for sale immediately prior to the sale action recognizing that under FIFO, the earliest purchases test e d to be the best o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts