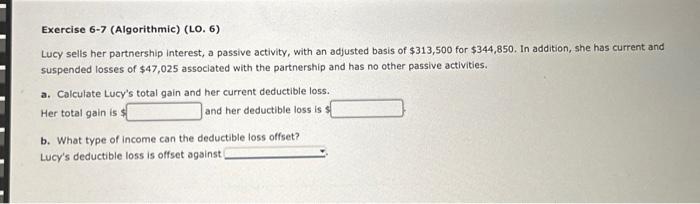

Question: Exercise 6-7 (Algorithmic) (LO. 6) Lucy selis her partnership interest, a passive activity, with an adjusted basis of $313,500 for $344,850. In addition, she has

Exercise 6-7 (Algorithmic) (LO. 6) Lucy selis her partnership interest, a passive activity, with an adjusted basis of $313,500 for $344,850. In addition, she has current and suspended losses of $47,025 associated with the partnership and has no other passive activities. a. Calculate Lucy's total gain and her current deductible loss. Her total gain is $ and her deductible loss is $ b. What type of income can the deductible loss offset? Lucy's deductible loss is offset against

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock