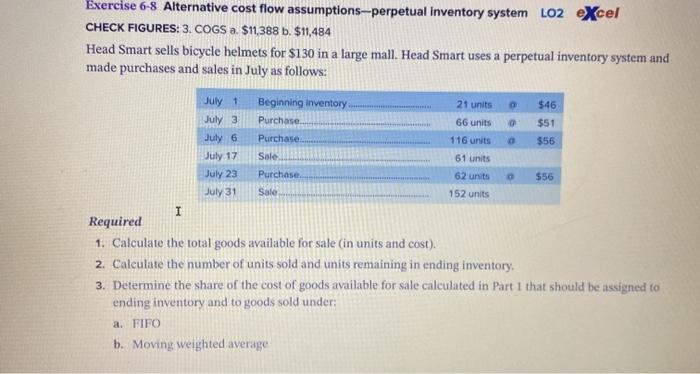

Question: Exercise 6-8 Alternative cost flow assumptions-perpetual Inventory system LO2 eXcel CHECK FIGURES: 3. COGS a. $11,388 b. $11,484 Head Smart sells bicycle helmets for $130

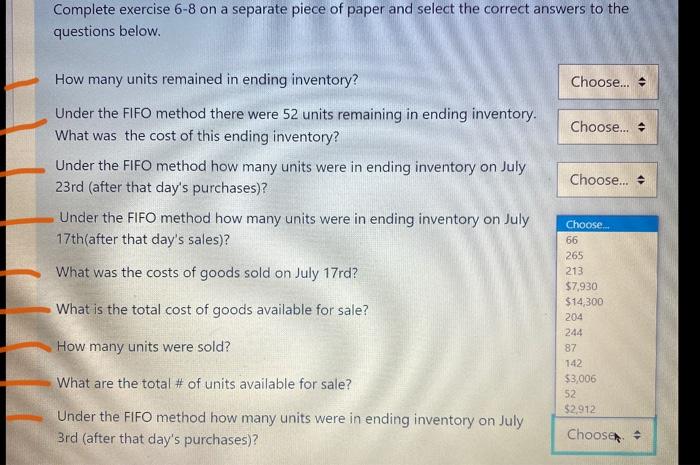

Exercise 6-8 Alternative cost flow assumptions-perpetual Inventory system LO2 eXcel CHECK FIGURES: 3. COGS a. $11,388 b. $11,484 Head Smart sells bicycle helmets for $130 in a large mall. Head Smart uses a perpetual inventory system and made purchases and sales in July as follows: 21 units Beginning inventory Purchase $46 66 units $51 $56 Purchase 116 units July 1 July 3 July 6 July 17 July 23 July 31 Sale 61 units 62 units 152 units Purchase Sale $56 I Required 1. Calculate the total goods available for sale (in units and cost). 2. Calculate the number of units sold and units remaining in ending inventory. 3. Determine the share of the cost of goods available for sale calculated in Part 1 that should be assigned to ending inventory and to goods sold under: a FIFO b. Moving weighted average Complete exercise 6-8 on a separate piece of paper and select the correct answers to the questions below. Choose... Choose... How many units remained in ending inventory? Under the FIFO method there were 52 units remaining in ending inventory. What was the cost of this ending inventory? Under the FIFO method how many units were in ending inventory on July 23rd (after that day's purchases)? Under the FIFO method how many units were in ending inventory on July 17th(after that day's sales)? What was the costs of goods sold on July 17rd? Choose... What is the total cost of goods available for sale? Choose... 66 265 213 $7,930 $14,300 204 244 87 742 $3,006 52 $2.912 How many units were sold? What are the total # of units available for sale? Under the FIFO method how many units were in ending inventory on July 3rd (after that day's purchases)? Chooser +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts