Question: Exercise 6-9 (Algorithmic) (LO. 9) Noah Yobs, who has $68,200 of AGI before considering rental activities, has $61,380 of losses from a real estate rental

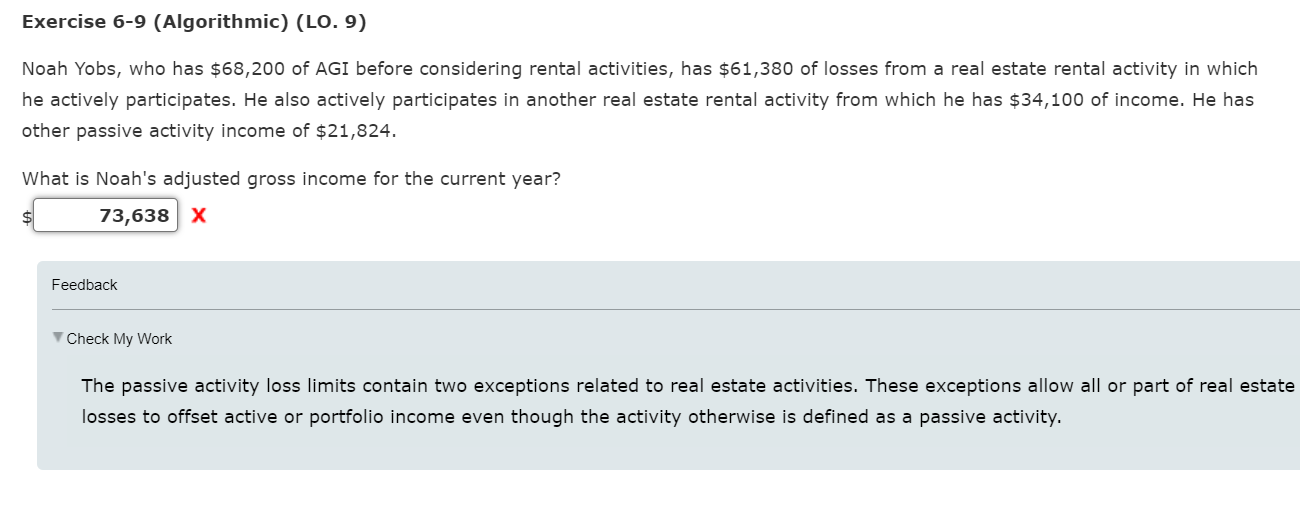

Exercise 6-9 (Algorithmic) (LO. 9) Noah Yobs, who has $68,200 of AGI before considering rental activities, has $61,380 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $34,100 of income. He has other passive activity income of $21,824. What is Noah's adjusted gross income for the current year? $ 73,638 x Feedback Check My Work The passive activity loss limits contain two exceptions related to real estate activities. These exceptions allow all or part of real estate losses to offset active or portfolio income even though the activity otherwise is defined as a passive activity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts