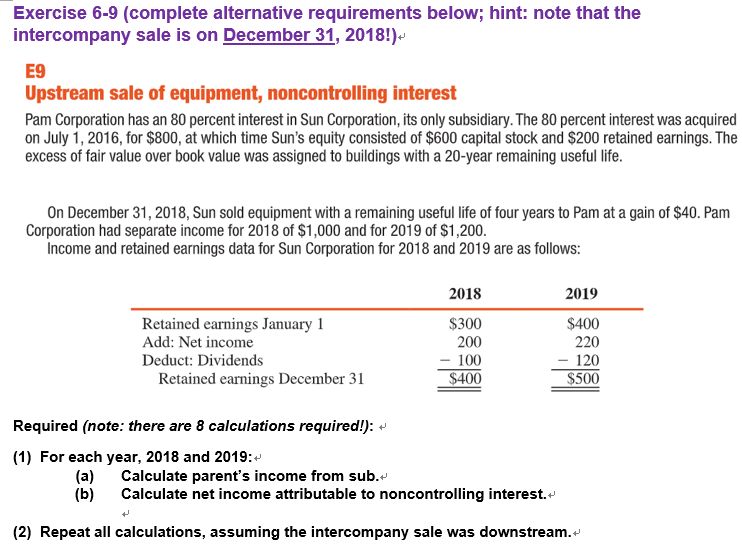

Question: Exercise 6-9 (complete alternative requirements below; hint: note that the intercompany sale is on December 31, 2018!)- E9 Upstream sale of equipment, noncontrolling interest Pam

Exercise 6-9 (complete alternative requirements below; hint: note that the intercompany sale is on December 31, 2018!)- E9 Upstream sale of equipment, noncontrolling interest Pam Corporation has an 80 percent interest in Sun Corporation, its only subsidiary. The 80 percent interest was acquired on July 1, 2016, for $800, at which time Sun's equity consisted of $600 capital stock and $200 retained earnings. The excess of fair value over book value was assigned to buildings with a 20-year remaining useful life. On December 31, 2018, Sun sold equipment with a remaining useful life of four years to Pam at a gain of $40. Pam Corporation had separate income for 2018 of $1,000 and for 2019 of $1,200. Income and retained earnings data for Sun Corporation for 2018 and 2019 are as follows: Retained earnings January 1 Add: Net income Deduct: Dividends Retained earnings December 31 2018 $300 200 100 $400 2019 $400 220 120 $500 Required (note: there are 8 calculations required!): (1) For each year, 2018 and 2019:- (a) Calculate parent's income from sub. (b) Calculate net income attributable to noncontrolling interest. t (2) Repeat all calculations, assuming the intercompany sale was downstream. Exercise 6-9 (complete alternative requirements below; hint: note that the intercompany sale is on December 31, 2018!)- E9 Upstream sale of equipment, noncontrolling interest Pam Corporation has an 80 percent interest in Sun Corporation, its only subsidiary. The 80 percent interest was acquired on July 1, 2016, for $800, at which time Sun's equity consisted of $600 capital stock and $200 retained earnings. The excess of fair value over book value was assigned to buildings with a 20-year remaining useful life. On December 31, 2018, Sun sold equipment with a remaining useful life of four years to Pam at a gain of $40. Pam Corporation had separate income for 2018 of $1,000 and for 2019 of $1,200. Income and retained earnings data for Sun Corporation for 2018 and 2019 are as follows: Retained earnings January 1 Add: Net income Deduct: Dividends Retained earnings December 31 2018 $300 200 100 $400 2019 $400 220 120 $500 Required (note: there are 8 calculations required!): (1) For each year, 2018 and 2019:- (a) Calculate parent's income from sub. (b) Calculate net income attributable to noncontrolling interest. t (2) Repeat all calculations, assuming the intercompany sale was downstream

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts