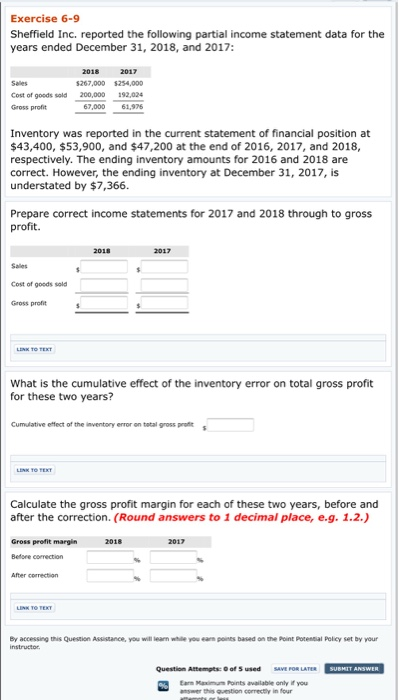

Question: Exercise 6-9 Sheffield Inc. reported the following partial income statement data for the years ended December 31, 2018, and 2017: 2018 2017 Sales 5267,000 $254,000

Exercise 6-9 Sheffield Inc. reported the following partial income statement data for the years ended December 31, 2018, and 2017: 2018 2017 Sales 5267,000 $254,000 Cost of goods sold 200,000 192.024 Gross profit 67,000 61,976 Inventory was reported in the current statement of financial position at $43,400, $53,900, and $47,200 at the end of 2016, 2017, and 2018, respectively. The ending inventory amounts for 2016 and 2018 are correct. However, the ending inventory at December 31, 2017, is understated by $7,366. Prepare correct income statements for 2017 and 2018 through to gross profit. 2018 2017 Cost of goods sold Gross pront LINK TO TEXT What is the cumulative effect of the inventory error on total gross profit for these two years? Cumulative effect of the inventory error on total gross profit LINK TO TEXT Calculate the gross profit margin for each of these two years, before and after the correction. (Round answers to 1 decimal place, e.g. 1.2.) 2018 2017 Gross profit margin Before correction After correction LINK TO TEXT By accessing this Question Assistance, you will learn while you can points based on the point Potential policy set by your instructor SUBMIT ANSWER Question Attempts of used SAVE FOR LATER Earn Maximus Points available only if you answer this westion correctly in four

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts