Question: Exercise 7 - 2 4 ( Algo ) Assigning Costs to Jobs ( LO 7 - 1 ) Barker Products is a job shop. The

Exercise Algo Assigning Costs to Jobs LO

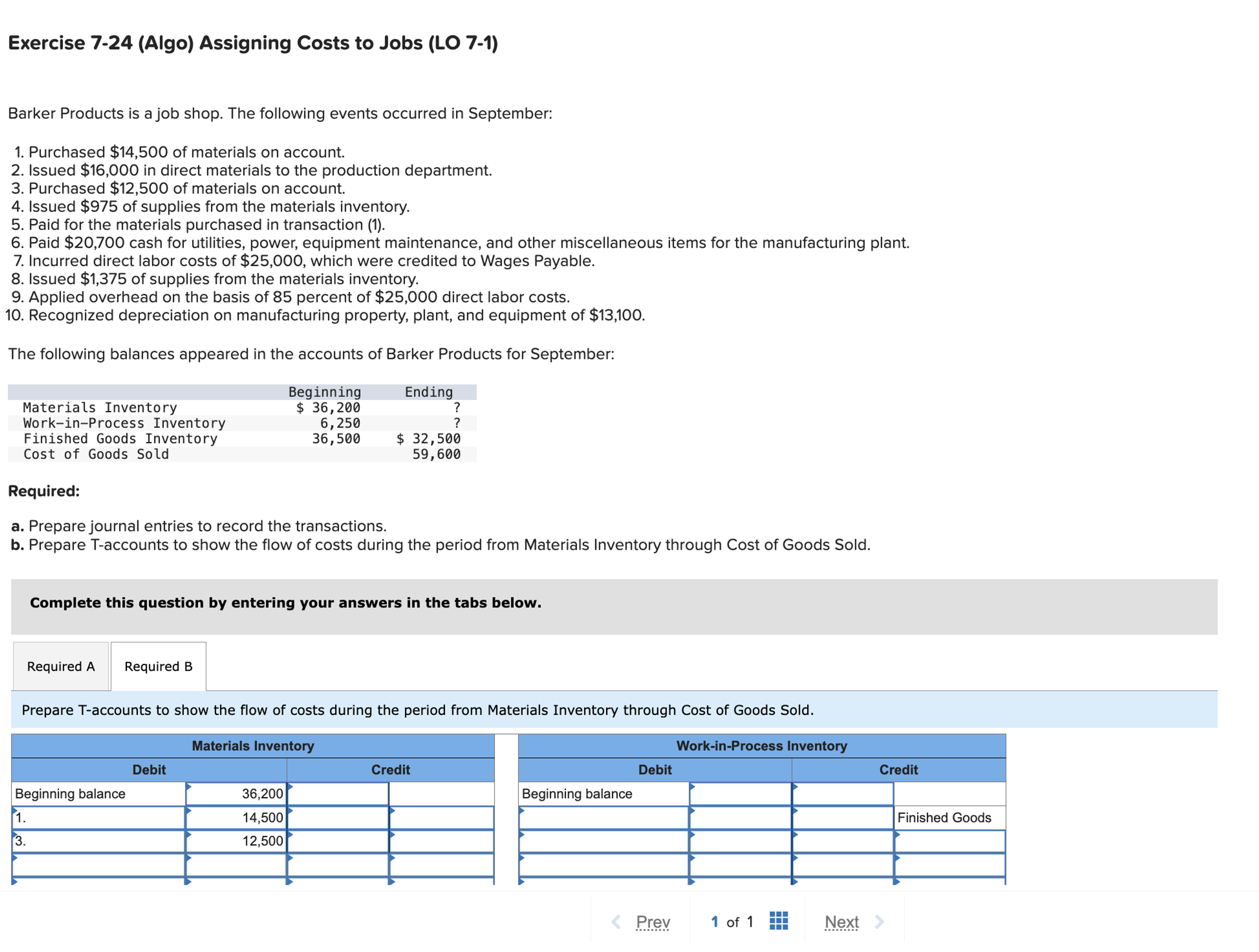

Barker Products is a job shop. The following events occurred in September:

Purchased $ of materials on account.

Issued $ in direct materials to the production department.

Purchased $ of materials on account.

Issued $ of supplies from the materials inventory.

Paid for the materials purchased in transaction

Paid $ cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing plant.

Incurred direct labor costs of $ which were credited to Wages Payable.

Issued $ of supplies from the materials inventory.

Applied overhead on the basis of percent of $ direct labor costs.

Recognized depreciation on manufacturing property, plant, and equipment of $

The following balances appeared in the accounts of Barker Products for September:

Required:

a Prepare journal entries to record the transactions.

b Prepare Taccounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold.

Complete this question by entering your answers in the tabs below.

Prepare Taccounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold.

Prev

of

Next Wages Payable

Applied Manufacturing Overhead

Finished Goods Inventory

Cost of Goods Sold

Prev

of

NextBarker Products is a job shop. The following events occurred in September:

Purchased $ of materials on account.

Issued $ in direct materials to the production department.

Purchased $ of materials on account.

Issued $ of supplies from the materials inventory.

Paid for the materials purchased in transaction

Paid $ cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing plant.

Incurred direct labor costs of $ which were credited to Wages Payable.

Issued $ of supplies from the materials inventory.

Applied overhead on the basis of percent of $ direct labor costs.

Recognized depreciation on manufacturing property, plant, and equipment of $

The following balances appeared in the accounts of Barker Products for September:

Beginning Ending

Materials Inventory $ Question mark

WorkinProcess Inventory Question mark

Finished Goods Inventory $

Cost of Goods Sold

Required:

Prepare journal entries to record the transactions.

Prepare Taccounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock