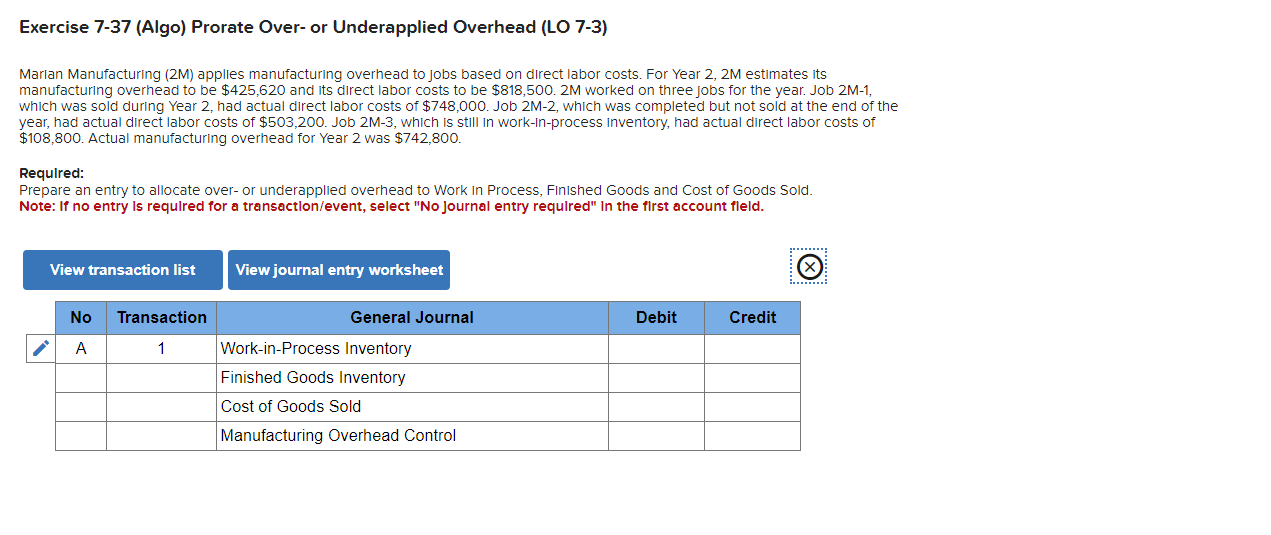

Question: Exercise 7 - 3 7 ( Algo ) Prorate Over - or Underapplied Overhead ( LO 7 - 3 ) Marlan Manufacturing ( 2 M

Exercise Algo Prorate Over or Underapplied Overhead LO

Marlan Manufacturing M applies manufacturing overhead to jobs based on direct labor costs. For Year M estimates its

manufacturing overhead to be $ and its direct labor costs to be $ worked on three jobs for the year. Job

which was sold during Year had actual direct labor costs of $ Job which was completed but not sold at the end of the

year, had actual direct labor costs of $ Job M which is still in workInprocess inventory, had actual direct labor costs of

$ Actual manufacturing overhead for Year was $

Requlred:

Prepare an entry to allocate over or underapplied overhead to Work in Process, Finished Goods and Cost of Goods Sold.

Note: If no entry is required for a transactionevent select No journal entry required" In the flrst account fleld.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock