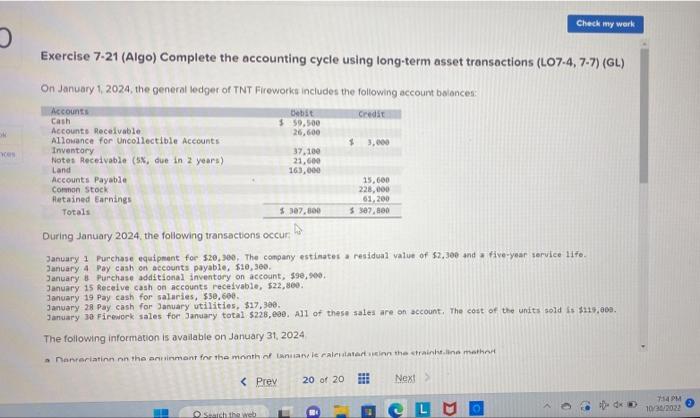

Question: Exercise 7-21 (Algo) Complete the accounting cycle using long-term asset transactions (LO7-4, 7-7) (GL) On January 1, 2024, the general ledger of TNT Fireworks includes

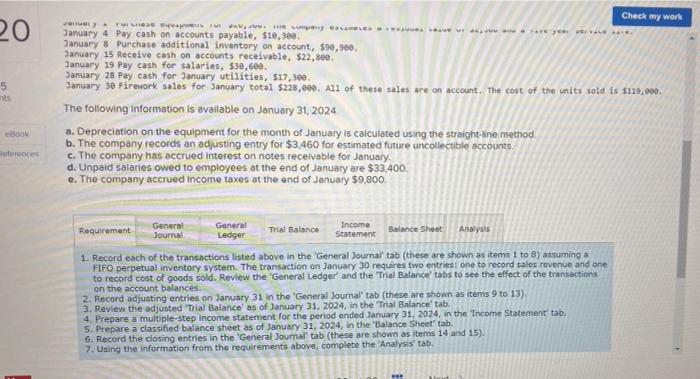

Exercise 7-21 (Algo) Complete the accounting cycle using long-term asset transactions (LO7-4, 7-7) (GL) On January 1, 2024, the general ledger of TNT Fireworks includes the following account boiances: During January 2024, the following transactions occur: January 1 Purchase equipmant for 520,300 , The conpany estinates a residual yalue of 52.300 and a five-year service 117 . January 4 Pay cash on accounts payable, $10,360. January \& Purchase additional inventory on account, $98,900. January 15 Recelve cash on accounts recelvable, 522,860 . January 19 Pay cash for salaries, 330,600 . Janvary 28 Pay cash for January utilities, $17,300. January 30 Firework sales for January total $228, e9e. All of these sales are on account. The cost of the units sold is s115, 009 . The following information is available on January 31, 2024 Jamary 4 Pay cash on accounts payable, 51e, 309. January 8 Purchase additional inventory on account, $90,909. January 15 Recoive cash on accounts receivable, $22,80e. January 19 Pay cash for salaries, $30,600. January 28 Pay cash for January utilities, \$17, 3ee. January 30 firework sales for Janyary total $228,065. A1I of these sales are on account. The cost of the units sold is 5119 , 009. The following information is available on January 31,2024 a. Depreciation on the equipment for the month of January is calcutated using the straight-ine method. b. The company records an adjusting entry for $3,460 for estimated future uncollectible accounts. c. The company has accrued interest on notes receivable for January. d. Unpaid salaries owed to employees at the end of January are $33,400. e. The company accrued income taxes at the end of January $9,800 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 to 8 ) assuming a FIFO perpetual inventory system. The transaction on January 30 requires two entries: one to record sales revenue and one to record cost of goods sold. Review the 'General Ledger' and the Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record acjusting entries on January 31 in the 'General Journal' tab (these are shown as itemis 9 to 13). 3. Review the adjusted 'Trial Balance' as of January 31, 2024, in the 'Trial Brilance' tab. 4. Prepare a multiple-step income statement for the period ended January 31, 2024, in the 'Incame Statement' tab. 5. Prepare a classified balance sheet as of January 31,2024 , in the 'Batance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shown as items 14 and 15). 7. Using the information from the requirements above, complete the 'Analysis' tab. Exercise 7-21 (Algo) Complete the accounting cycle using long-term asset transactions (LO7-4, 7-7) (GL) On January 1, 2024, the general ledger of TNT Fireworks includes the following account boiances: During January 2024, the following transactions occur: January 1 Purchase equipmant for 520,300 , The conpany estinates a residual yalue of 52.300 and a five-year service 117 . January 4 Pay cash on accounts payable, $10,360. January \& Purchase additional inventory on account, $98,900. January 15 Recelve cash on accounts recelvable, 522,860 . January 19 Pay cash for salaries, 330,600 . Janvary 28 Pay cash for January utilities, $17,300. January 30 Firework sales for January total $228, e9e. All of these sales are on account. The cost of the units sold is s115, 009 . The following information is available on January 31, 2024 Jamary 4 Pay cash on accounts payable, 51e, 309. January 8 Purchase additional inventory on account, $90,909. January 15 Recoive cash on accounts receivable, $22,80e. January 19 Pay cash for salaries, $30,600. January 28 Pay cash for January utilities, \$17, 3ee. January 30 firework sales for Janyary total $228,065. A1I of these sales are on account. The cost of the units sold is 5119 , 009. The following information is available on January 31,2024 a. Depreciation on the equipment for the month of January is calcutated using the straight-ine method. b. The company records an adjusting entry for $3,460 for estimated future uncollectible accounts. c. The company has accrued interest on notes receivable for January. d. Unpaid salaries owed to employees at the end of January are $33,400. e. The company accrued income taxes at the end of January $9,800 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 to 8 ) assuming a FIFO perpetual inventory system. The transaction on January 30 requires two entries: one to record sales revenue and one to record cost of goods sold. Review the 'General Ledger' and the Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record acjusting entries on January 31 in the 'General Journal' tab (these are shown as itemis 9 to 13). 3. Review the adjusted 'Trial Balance' as of January 31, 2024, in the 'Trial Brilance' tab. 4. Prepare a multiple-step income statement for the period ended January 31, 2024, in the 'Incame Statement' tab. 5. Prepare a classified balance sheet as of January 31,2024 , in the 'Batance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shown as items 14 and 15). 7. Using the information from the requirements above, complete the 'Analysis' tab

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts