Question: Exercise 7-28 (Algorithmic) (LO. 6) Tim, a single taxpayer, operates a business as a single-member LLC. In 2023, his LLC reports business income of $409,500

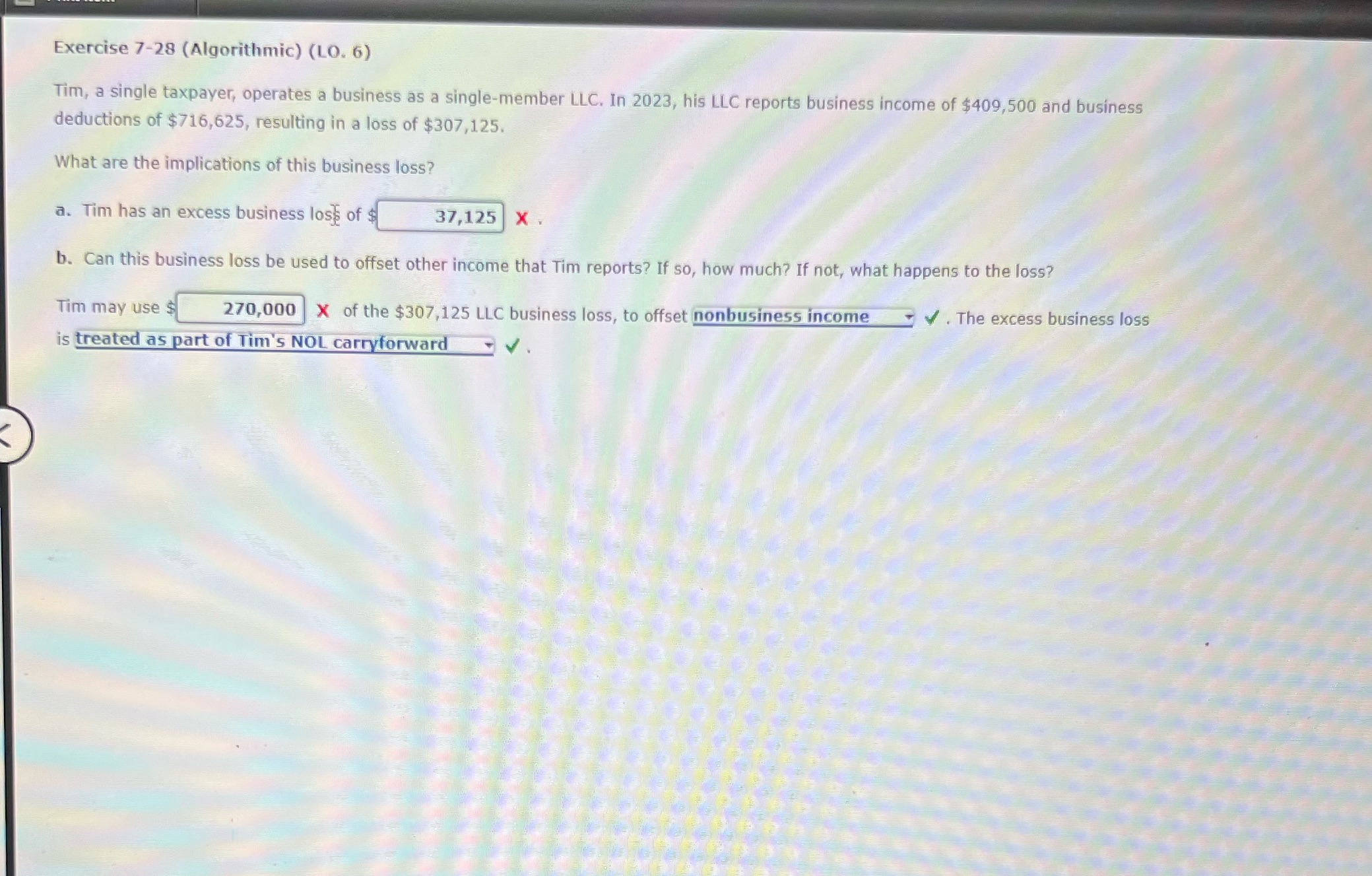

Exercise 7-28 (Algorithmic) (LO. 6) Tim, a single taxpayer, operates a business as a single-member LLC. In 2023, his LLC reports business income of $409,500 and business deductions of $716,625, resulting in a loss of $307,125. What are the implications of this business loss? a. Tim has an excess business loss of $ 37,125 X . b. Can this business loss be used to offset other income that Tim reports? If so, how much? If not, what happens to the loss? Tim may uses 270,000 X of the $307,125 LLC business loss, to offset nonbusiness income V . The excess business loss is treated as part of Tim's NOL carryforward

Exercise 7-28 (Algorithmic) (LO. 6) Tim, a single taxpayer, operates a business as a single-member LLC. In 2023, his LLC reports business income of $409,500 and business deductions of $716,625, resulting in a loss of $307,125. What are the implications of this business loss? a. Tim has an excess business loss of $ 37,125 X . b. Can this business loss be used to offset other income that Tim reports? If so, how much? If not, what happens to the loss? Tim may uses 270,000 X of the $307,125 LLC business loss, to offset nonbusiness income V . The excess business loss is treated as part of Tim's NOL carryforward

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock