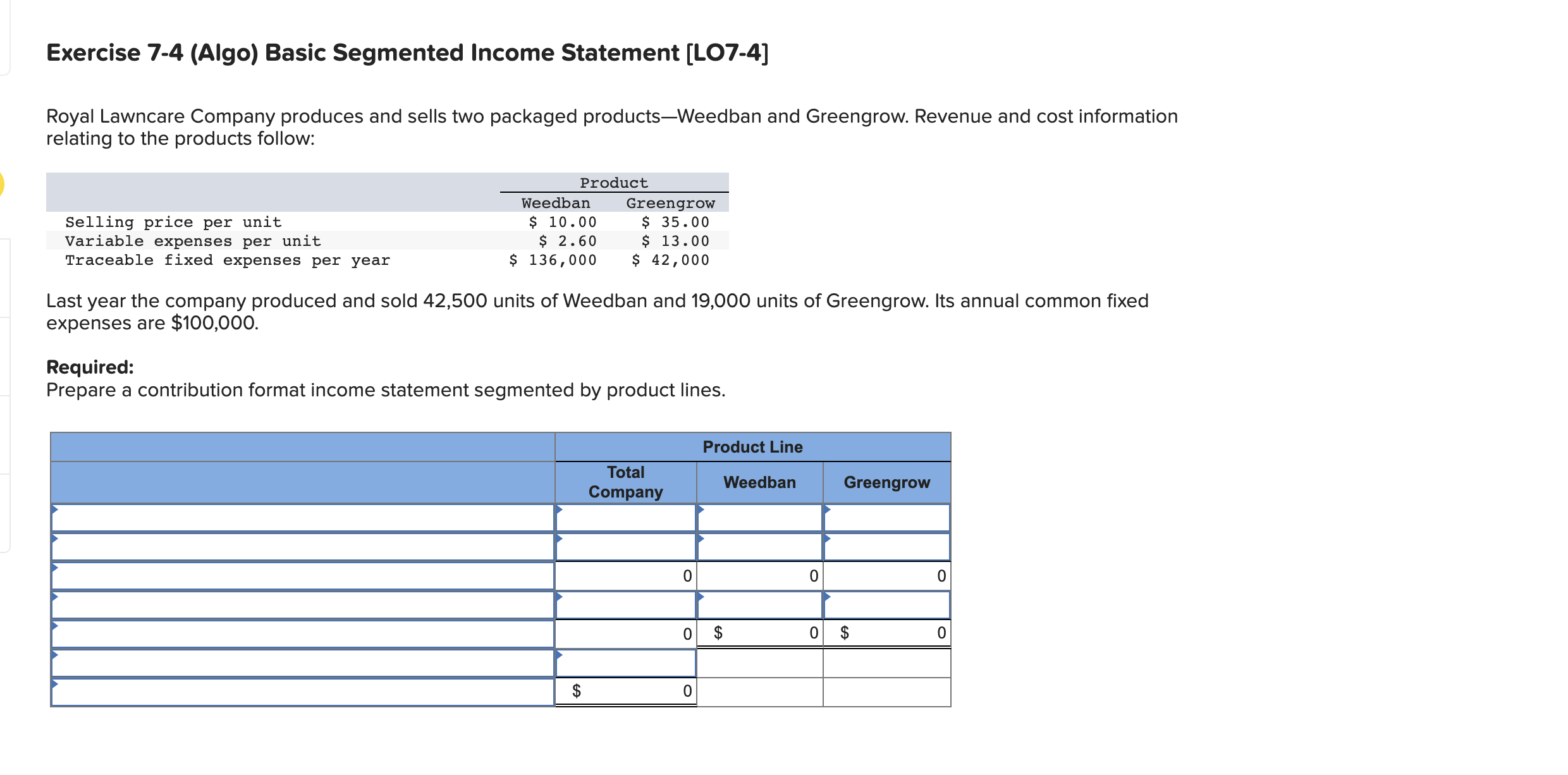

Question: Exercise 7-4 (Algo) Basic Segmented Income Statement [LO7-4] Royal Lawncare Company produces and sells two packaged productsWeedban and Greengrow. Revenue and cost information relating to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts