Question: Exercise 7-6 Your answer is partially correct. Try again. Rachel Sells is unable to reconcile the bank balance at January 31. Rachel's reconciliation is shown

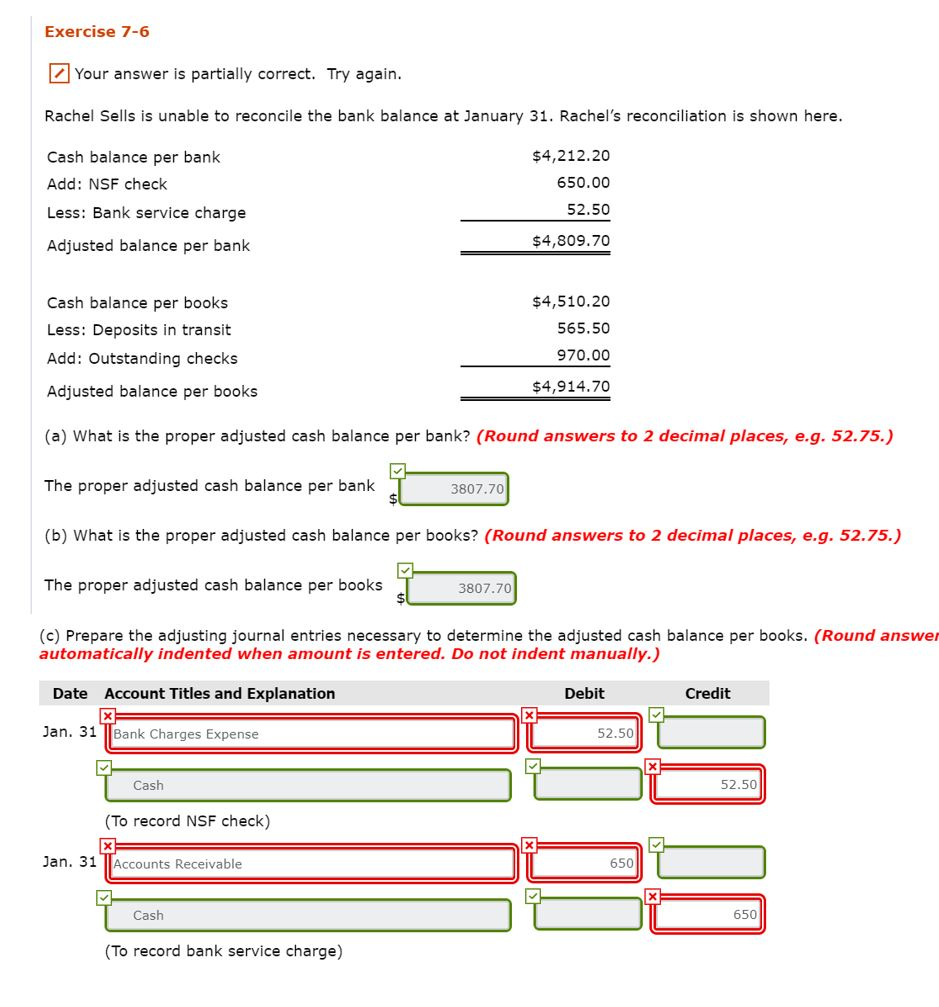

Exercise 7-6 Your answer is partially correct. Try again. Rachel Sells is unable to reconcile the bank balance at January 31. Rachel's reconciliation is shown here Cash balance per bank Add: NSF check Less: Bank service charge Adjusted balance per bank $4,212.20 650.00 52.50 $4,809.70 Cash balance per books Less: Deposits in transit Add: Outstanding checks Adjusted balance per books $4,510,20 565.50 970.00 $4,914.70 (a) What is the proper adjusted cash balance per bank? (Round answers to 2 decimal places, e.g. 52.75.) The proper adjusted cash balance per bank (b) What is the proper adjusted cash balance per books? (Round answers to 2 decimal places, e.g. 52.75.) The proper adjusted cash balance per books (c) Prepare the adjusting journal entries necessary to determine the adjusted cash balance per books. (Round answer 3807.70 3807.70 automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31 Bank Charges Expense 52.50 Cash 52.50 (To record NSF check) Jan. 31 Accounts Receivable 650 Cash 650 (To record bank service charge)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts